Focus on Customer Experience

The emphasis on customer experience is a pivotal driver in the Argentina business process management market. Organizations are increasingly aware that enhancing customer satisfaction is essential for retaining clients and driving revenue growth. BPM solutions enable businesses to analyze customer interactions and streamline processes to improve service delivery. Recent market data indicates that companies that prioritize customer experience through BPM initiatives can achieve a 25% increase in customer retention rates. This focus on customer-centric approaches is likely to encourage more businesses in Argentina to invest in BPM solutions, thereby expanding the market. As organizations strive to differentiate themselves in a crowded marketplace, the role of BPM in enhancing customer experience will continue to gain prominence.

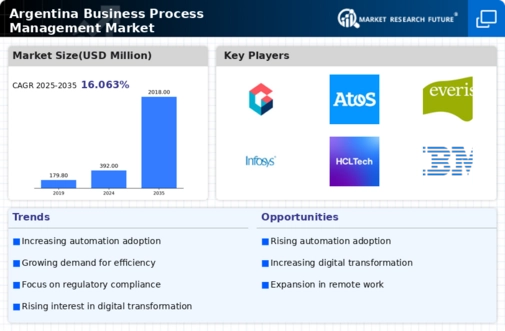

Growing Demand for Efficiency

The Argentina business process management market is witnessing a growing demand for efficiency across various sectors. Organizations are increasingly recognizing the need to streamline operations and reduce costs. According to recent data, companies that have implemented business process management (BPM) solutions report a 20% increase in operational efficiency. This trend is driven by the competitive landscape, where businesses strive to enhance productivity and deliver better customer experiences. As a result, BPM solutions are being adopted not only by large enterprises but also by small and medium-sized enterprises (SMEs) in Argentina, indicating a broadening market base. The emphasis on efficiency is likely to propel the growth of the BPM market, as organizations seek to optimize their processes and achieve sustainable growth.

Digital Transformation Initiatives

The ongoing digital transformation initiatives within the Argentina business process management market are reshaping how organizations operate. As businesses increasingly embrace digital technologies, there is a corresponding rise in the adoption of BPM solutions to facilitate this transition. The government has been promoting digitalization through various programs, which has led to a surge in investments in technology. Recent statistics indicate that over 60% of companies in Argentina are prioritizing digital transformation, with BPM being a key component of their strategies. This trend not only enhances operational efficiency but also improves customer engagement and satisfaction. Consequently, the BPM market is poised for growth as organizations seek to leverage technology to remain competitive in an evolving landscape.

Emergence of Cloud-Based Solutions

The emergence of cloud-based solutions is transforming the Argentina business process management market. As organizations seek flexibility and scalability, cloud-based BPM solutions are becoming increasingly attractive. These solutions allow businesses to access BPM tools without the need for extensive on-premises infrastructure, thereby reducing costs and implementation time. Recent data suggests that the adoption of cloud-based BPM solutions in Argentina has increased by 30% over the past year. This trend is particularly beneficial for SMEs, which may lack the resources for traditional BPM implementations. The shift towards cloud technology is likely to drive further growth in the BPM market, as organizations recognize the advantages of agility and cost-effectiveness that cloud solutions offer.

Regulatory Compliance and Risk Management

In the Argentina business process management market, regulatory compliance and risk management are becoming increasingly critical. The government has introduced various regulations aimed at enhancing transparency and accountability in business operations. Companies are compelled to adopt BPM solutions to ensure compliance with these regulations, which can be complex and multifaceted. For instance, organizations that utilize BPM tools can better manage their compliance processes, reducing the risk of penalties and enhancing their reputation. The market data suggests that firms focusing on compliance through BPM are likely to experience a 15% reduction in compliance-related costs. This driver indicates a significant opportunity for BPM providers to offer tailored solutions that address the specific regulatory challenges faced by businesses in Argentina.