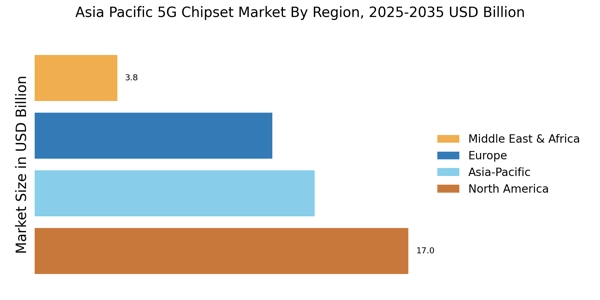

China : Unmatched Market Share and Growth

China holds a commanding market share of 48.5% in the APAC 5G chipset market, valued at $1450.0 million. Key growth drivers include rapid urbanization, increased demand for high-speed internet, and government initiatives promoting 5G technology. The Chinese government has implemented favorable regulatory policies, such as subsidies for 5G infrastructure development, which have spurred industrial growth and innovation in the tech sector. Additionally, the expansion of smart cities and IoT applications is driving consumption patterns towards advanced chipsets.

India : Government Initiatives Fuel Growth

India's 5G chipset market is valued at $800.0 million, accounting for 27.5% of the APAC market. The government's push for Digital India and initiatives like the National Digital Communications Policy are key growth drivers. Demand is surging in urban areas, particularly in states like Maharashtra and Karnataka, where tech adoption is high. The competitive landscape features major players like Qualcomm and MediaTek, who are investing heavily in local partnerships to enhance market penetration and cater to the growing demand for mobile broadband services.

Japan : Strong Focus on R&D Investments

Japan's 5G chipset market is valued at $500.0 million, representing 17.2% of the APAC market. The country is characterized by its strong emphasis on R&D, with significant investments from both government and private sectors. Key growth drivers include the demand for advanced telecommunications and smart manufacturing solutions. Regulatory support for 5G deployment and collaboration between tech giants like Sony and NTT Docomo are enhancing infrastructure development, making Japan a leader in 5G technology adoption.

South Korea : Leading in Network Infrastructure

South Korea's 5G chipset market is valued at $400.0 million, capturing 13.8% of the APAC market. The country is a pioneer in 5G technology, driven by government initiatives and substantial investments in network infrastructure. Cities like Seoul and Busan are at the forefront of 5G adoption, with applications in smart cities and autonomous vehicles. Major players like Samsung and LG are heavily involved in the competitive landscape, focusing on innovation and partnerships to enhance their market presence.

Malaysia : Strategic Investments in Infrastructure

Malaysia's 5G chipset market is valued at $150.0 million, accounting for 5.2% of the APAC market. The government is actively promoting 5G through the National Digital Economy Framework, which aims to enhance connectivity and digital services. Demand is growing in urban centers like Kuala Lumpur and Penang, where tech adoption is increasing. The competitive landscape includes local players and international firms like Huawei, focusing on infrastructure development and smart city projects to drive growth.

Thailand : Focus on Digital Transformation

Thailand's 5G chipset market is valued at $100.0 million, representing 3.5% of the APAC market. The government's Thailand 4.0 initiative is a key growth driver, promoting digital transformation across various sectors. Urban areas like Bangkok are witnessing increased demand for high-speed internet and smart technologies. The competitive landscape features both local and international players, with a focus on enhancing mobile broadband services and IoT applications to meet consumer needs.

Indonesia : Rising Urbanization and Demand

Indonesia's 5G chipset market is valued at $90.0 million, making up 3.1% of the APAC market. Rapid urbanization and a growing middle class are key growth drivers, leading to increased demand for mobile connectivity. Government initiatives aimed at improving digital infrastructure are also contributing to market growth. Key cities like Jakarta and Surabaya are central to this demand, with major players like Qualcomm and MediaTek focusing on local partnerships to enhance their market presence and cater to diverse consumer needs.

Rest of APAC : Varied Growth Across Regions

The Rest of APAC 5G chipset market is valued at $350.43 million, accounting for 12.1% of the overall APAC market. This sub-region encompasses a mix of developed and developing markets, each with unique growth drivers. Regulatory support for 5G deployment varies, influencing demand trends. Countries like Vietnam and the Philippines are witnessing increased investments in digital infrastructure, while local players and international firms compete to capture market share. The focus is on enhancing connectivity and supporting emerging technologies across various sectors.