Market Analysis

In-depth Analysis of Asia Pacific Cell Counting Market Industry Landscape

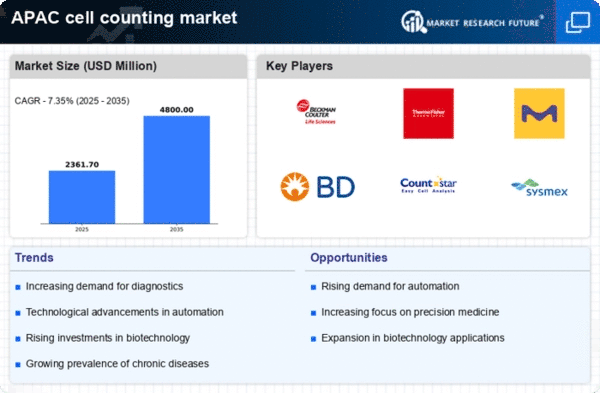

There is a lot of growth in the Asia-Pacific Cell Counting Market. This is due to more research being done, more people getting chronic diseases, and better healthcare facilities. In many science and medical fields, it is very important to be able to count and study cells. This market is all about technologies and tools that help with that. A big thing that changes how the market works is the strong rise in research and development in the Asia-Pacific area. A big part of biological study is counting cells. As the biotechnology and pharmaceutical companies grow in the area, they need more accurate and quick tools for counting cells. The way markets work is changing because more and more people in Asia and the Pacific have long-term illnesses. It is important to know how to count cells in order to understand and diagnose illnesses like cancer and inflammatory disorders. Cell measuring tools are being used to study and treat diseases because of this. Things work better in the market when more money is put into life sciences. Asia-Pacific companies and governments are putting more money into the life sciences field. This means that areas like genomics, drug discovery, and stem cell studies need more ways to count cells. As the biotech business grows in Asia and the Pacific, it changes the market in big ways. It is important to count cells in bioprocessing because it is used to make cell lines and medicines. This is why biotech companies need cell counting tools that are reliable and can be used on a large scale. People want to be able to do tests at the point of care, which is a big trend that is changing how the market works. More and more, tools that count cells are being used for quick diagnoses right where they are. It's because people need answers right away in places like clinics, medical sites that are far away, and field study. How markets work is affected by the rules that guide them. People in the market need to be very careful to follow the laws and rules for cell measuring tools. It is important to follow quality and safety rules in order to get government support and build trust with end users. There is a lot of competition in the Asia Pacific Cell Counting Market. The things that make a business stand out are its goods, how simple they are to use, and how well they work with different kinds of samples. This race helps people come up with new ideas and makes cell counting technology better. The way the market works is changing because companies and schools are working together and forming relationships. Partners in these types of relationships try to use each other's skills, share resources, and spark new ideas in order to make and sell better tools for counting cells. More and more people want cell counting apps that can be changed to meet different needs. Healthcare, study, and bioprocessing are just a few of the industries that need certain things. People like to buy instruments that can be changed to meet these needs. Making changes to the way markets work is the search for new ones in the Asia-Pacific area. With their growing life sciences industries, China and India have a lot of room to grow, so businesses are planning to set up shop in these places. As time goes on, we can expect more automatic cell counting to be done with artificial intelligence (AI), portable and small cell counting devices to be made, and improvements in multimodal cell analysis that give us a better picture of how cells act.

Leave a Comment