Market Share

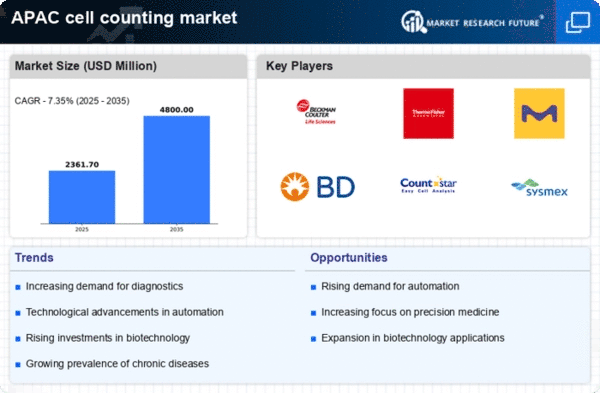

Asia Pacific Cell Counting Market Share Analysis

This is the Asia Pacific Cell Counting Market. It is a very busy and quickly rising market in the life sciences and tests. There are many businesses in this area that want to stay ahead of the competition and get a bigger share of the growing market for devices that count cells. Businesses pay attention to customizing their goods for the Asian-Pacific region because they know that each country has unique needs. You can get deeper into the market and build a better place by making cell counting solutions that work with different languages, regional preferences, and government rules. One important thing to do in this market is to use tools that can count cells instantly. Businesses spend money on automatic cell counting systems that are easy to use, work quickly, and do the right thing. The Asia-Pacific region needs more and more lab processes that work quickly and well, and automation can help with that. One important way to stand out in the market is to work with well-known universities and study groups. Companies work together to help with research projects, find out more about how the market is changing, and make study and academic groups more likely to trust their cell tracking tools. Businesses in the Asia-Pacific region try to keep prices low because the economies aren't all the same. Cell counting tools are easy for more people to get to when they offer discounts, fair prices, and different ways to pay. You can meet more people and get a bigger share of the market this way. Companies are getting ready for more business by focusing on high-throughput cell counting options. This is because labs in the Asia-Pacific region are getting busy. Labs that have to deal with a lot of requests like systems that can easily handle a lot of samples. This helps the market grow. In each country, it's important to follow the different rules and laws. Getting the licenses they need and making sure they meet the standards in their area are very important to businesses. When the company localizes product documents, help, and training tools, it does even better in the Asia-Pacific market. It is smart to put money into organizations that teach and train people. Companies that train users, lab workers, and academics on how to use their cell counting technologies properly help make sure that those technologies are used correctly. This makes people happy, keeps them coming back, and grows your market share. Using e-commerce and other online platforms for marketing is a modern way to do things. There is no doubt that businesses need websites to get their goods seen and used by people. Being strong online makes it simple for people in the Asia-Pacific region to buy things, which helps the business grow its market share. Giving great customer service and help after the sale is a simple way to set yourself apart in the market. Customers are happy with companies that offer quick technical help, regular fix plans, and good troubleshooting. This makes customers loyal and likely to buy from those companies again. When advertising in Asia-Pacific, companies need to consider local tastes and customs. Local ads are targeted by companies. This boosts their market position by promoting their cell counting technology.

Leave a Comment