Market Trends

Key Emerging Trends in the Asia Pacific Cell Counting Market

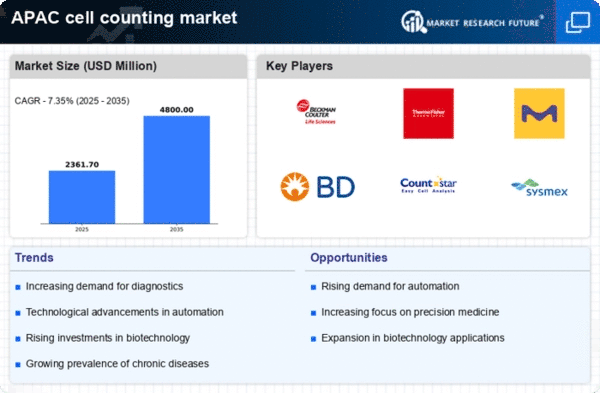

Business and government groups all over the Asia-Pacific area give a lot of money to study life sciences. Researchers are looking for safe ways to do things like study cells, keep cell cultures alive, and make new drugs. This is increasing the need for tools that count cells. It's clear that automatic cell counting methods are being used in more and more places in APAC. These methods are fast, accurate, and can be used again and again, among other things. They make counting cells more accurate and reduce the amount of work that needs to be done by hand, which makes them very popular in research and hospital labs. Stem cell research is getting more attention in the Asia-Pacific area. A big part of making stem cells grow and figuring out what they are is counting cells. As research into stem cell treatments and regenerative medicine grows, so does the need for accurate tools to count cells. AI is being used in gadgets that count cells, which is a trend that stands out. When AI is used to run cell counting devices, the process goes faster and is more accurate. This makes it easier to work with large datasets and helps scientists learn helpful things from living samples that are hard to understand. Point-of-care cell counting tools are becoming more popular because they can be used right where cells are needed and quickly. It is becoming more common to use these movable devices in hospitals, field studies, and other places with few resources. This is because they are simple to use and quickly count cells. The Asia-Pacific Cell Counting market is getting more creative because businesses, research institutions, and study groups are working together and forming partnerships. It is the goal of these agreements to share resources and knowledge in order to make and use new tools for counting cells more quickly. More and more is being done to let people know how important it is to count cells correctly in research and hospital settings. Through education programs, workshops, and training events, researchers and health care workers are getting better at using tools that count cells. Large companies in the Asia-Pacific Cell Counting market want to be more present in the area. To meet the growing demand and take advantage of the many new opportunities in the Asia-Pacific life sciences market, this means opening regional offices, delivery networks, and factories.

Leave a Comment