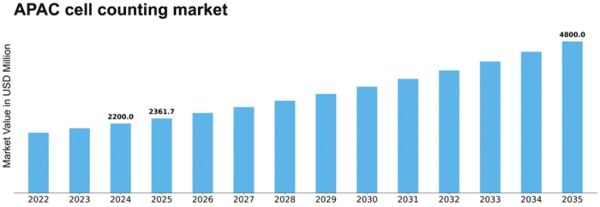

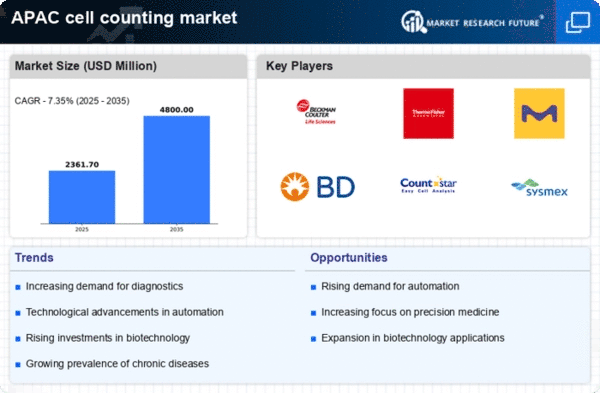

Asia Pacific Cell Counting Size

Asia Pacific Cell Counting Market Growth Projections and Opportunities

Most of the growth in the Asia-Pacific Cell Counting Market is due to more people in the area getting long-term sicknesses. More and more people are getting cancer, heart disease, and diabetes, which means that accurate ways to count cells are needed for research and detection. In the Asia-Pacific area, more money is being spent on studying life sciences, which changes the market. Universities, study groups, and science businesses buy high-tech tools for counting cells to help with various research projects. The market is getting bigger. The market is growing because the technology used in cell counting tools is always getting better. More and more people are interested in new ideas like automatic cell counts, flow cytometers, and image-based cell counting tools. More often than not, these tools speed up and improve the accuracy of cell research. More and more people in the Asia Pacific are using regenerative medicine, which is making it important to have good ways to count cells. For cell treatments and regenerative medicine to work well, the market needs to know the exact number of cells being used. A lot of Asian and Pacific countries are quickly building up their health care systems, which is good for businesses that make cell counts. As more labs, hospitals, and research centers open, more people will need improved cell counting tools to help them study and figure out what's wrong. A lot of the growth in the Asia-Pacific cell counting market comes from government programs that help businesses and study projects that make money. Life sciences study is very important to the states in this area, so they want to spend money on tools that help science move forward, like cell counting. In the Asia-Pacific area, precision medicine is becoming more popular, which means that better ways to count cells are needed. Personalized treatment plans need accurate cell analysis so that medicines can be made just for each patient. This means that more and more complicated cell counting technologies are being used. More and more clinical research is being done in Asia and the Pacific, which is making the cell counts market bigger. Many different diagnostic tasks are done with cell counting in hospital laboratories and diagnostic centers. These tasks range from counting blood cells to looking for infectious diseases. Partners from outside of Asia-Pacific are working with Asian study institutions to make it easier for people to share technology and knowledge. Working together in this way speeds up the use of more advanced cell counting methods. This makes sure that study in this area meets standards around the world. The market for counting cells is changing because more people are learning about how cells can be used to treat illnesses. More and more people are using advanced tools to count cells because they know how important it is to have accurate cell counts in cell-based treatments. The market has some good points, but it's hard to do business in some places because it's hard to get medical care. Health care infrastructure is being improved and more advanced testing tools are being made available to deal with these issues. When people work together like this, it helps the market grow.

Leave a Comment