Research Methodology on Asia Pacific Integrated Operating Room Systems Market

This research study is conducted to gain a comprehensive statistical overview of the Asia Pacific Integrated Operating Room (OR) System market. The research project is conducted in a systematic and structured manner and the ensuing sections give an overview of the research design employed. At the outset, a brief overview of the research objectives, scope of research, and data sources was detailed. Further, the primary and secondary research methods employed in the research study are elucidated. With this, the entire research process performed is provided, bringing out the key aspects of the research methodology.

Research objectives

The primary objective of this study is to analyze the growth of the Asia Pacific Integrated Operating Room (OR) System market, both current and future trends, over the forecast period i.e. 2023-2030. Moreover, the analysis is further broken down into the following sub-objectives-

- To understand the current and future trends of the Asia-Pacific Integrated Operating Room (OR) System market.

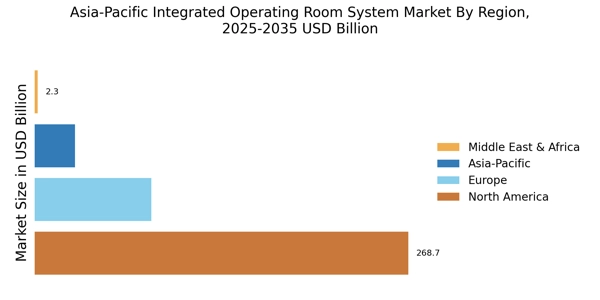

- To assess the performance of the Asia Pacific Integrated Operating Room (OR) System market by region.

- To identify various drivers and challenges to determine the future market of the Asia Pacific Integrated Operating Room (OR) System market.

- To analyze the trends and opportunities in the market.

- To benchmark and analyze the competitive landscape of the Asia Pacific Integrated Operating Room (OR) System market.

Scope of the research

The scope of the research covers the qualitative and quantitative analysis of the market, with detail on the market dynamics, value chain of the entire industry, and other factors contributing to the growth of the market. The different segments of the market are discussed with region-wise analysis, covering the Asia Pacific Integrated Operating Room (OR) System market across the globe. The research works further surveys the market competition, opportunities, regulation, and innovative trends as well as the technological advancements in the Asia Pacific Integrated Operating Room (OR) System market.

Data sources

Primary sources: Government websites, industry associations, journals and magazines, trade publications, industry databases, regulatory bodies, product catalogues, and other related documents were used as primary sources of information to understand the various drivers, trends, and challenges prevailing in the Asia Pacific Integrated Operating Room (OR) System market. The primary sources are also used to analyze players’ strategies, market forecasts and other information.

Secondary sources: Secondary sources of information for the research study includes financial and economic reports, industry publications, stock market analysis, and annual reports from various market participants. A list of sources used includes investor presentations, company news and important press releases, SEC filings, financials and analyst coverage, corporate presentations, and other important guides.

Research methodologies

The following methodology is used in conducting the research study-

- Data triangulation method: Data triangulation involves combining and evaluating different types of research data, such as primary and secondary sources, to gain a more comprehensive understanding of the market. This methodology is used to aid in providing reliable and accurate estimates of the market size, market shares and competitive landscape of different players in the Asia Pacific Integrated Operating Room (OR) System market.

- Porter's Five Forces Model: This model is used to help identify factors that influence the competitive dynamics of the Asia Pacific Integrated Operating Room (OR) System market. This model is used to help analyze the bargaining power of buyers and suppliers, competitive rivalry in the market, threat of new entrants and substitutes, and barrier of entry. This comprehensive analysis gave a comprehensive overview of the competitive environment in the Asia Pacific Integrated Operating Room (OR) System market.

- Market size assessment: An exhaustive market size assessment is conducted to accurately estimate the size of the Asia Pacific Integrated Operating Room (OR) System market. This process includes a detailed study of the historic and current data to infer an aggregate market size for 2022 and the forecasted size of the market until 2030.

- Estimation of market share: The estimated market shares of different participants in the Asia Pacific Integrated Operating Room (OR) System market is determined using a top-down approach. This is done by analyzing the market size and estimating the market share of various participants in the Asia Pacific Integrated Operating Room (OR) System market.

- SWOT analysis: This technique is used to identify the key strengths, weaknesses, opportunities and threats for the Asia Pacific Integrated Operating Room (OR) System market. This is done by analyzing the external and internal factors that are likely to impact the growth of the market.

- Hedonic pricing model: The hedonic pricing model is used to analyze the price factors and analyze the trends of supplying elements in the Asia Pacific Integrated Operating Room (OR) System market. This is done by analyzing the cost of established component values and using the structure of the component pricing structure to identify the impact that each component had on the final product.

- Data interpretation: This technique is utilized to achieve a comprehensive understanding of the market size, trends, competitive landscape, regional distribution, etc. This is done by interpreting the magnitude of factors like regional and global economic & political factors, market attractiveness and other current market forces.

The findings of the research study are validated by an external panel of industry experts, to ensure the reliability and accuracy of the report. Further, the research study also aims to bring out a better assessment of the various opportunities and takeaways in the Asia Pacific Integrated Operating Room (OR) System market by the use of different methodologies. With this, the study brings the analysis of the key segments and is expected to help key stakeholders in gaining comprehensive insights into the market.