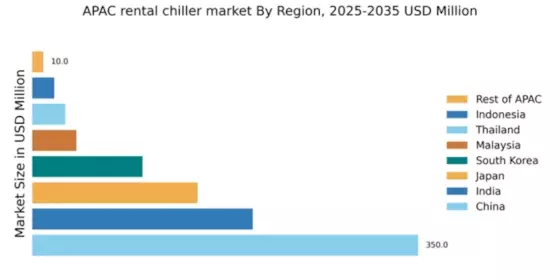

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 350.0, representing a significant portion of the APAC rental chiller market. Key growth drivers include rapid urbanization, industrial expansion, and increasing demand for energy-efficient cooling solutions. Government initiatives promoting green technologies and stringent regulations on energy consumption further fuel this growth. The infrastructure development, particularly in major cities, is also a critical factor, as it supports the rising demand for rental chillers in construction and industrial sectors.

India : Emerging Market with High Demand

India's rental chiller market is valued at 200.0, showcasing a robust growth trajectory driven by increasing temperatures and urbanization. The demand for temporary cooling solutions in sectors like construction, events, and manufacturing is on the rise. Government initiatives aimed at improving infrastructure and energy efficiency are also pivotal. The Make in India campaign encourages local manufacturing, which is expected to enhance market dynamics and reduce costs.

Japan : Innovation and Efficiency in Focus

Japan's rental chiller market is valued at 150.0, characterized by a stable demand driven by technological advancements and a focus on energy efficiency. The market is supported by stringent regulations on energy consumption and a growing emphasis on sustainable practices. The demand for rental chillers is particularly high in urban areas, where infrastructure development is ongoing, and industries are increasingly adopting advanced cooling solutions.

South Korea : Strong Demand in Urban Centers

South Korea's rental chiller market is valued at 100.0, with significant growth driven by urbanization and industrialization. The demand for efficient cooling solutions is rising, particularly in metropolitan areas like Seoul and Busan. Government policies promoting energy efficiency and sustainability are also influencing market dynamics. The competitive landscape features major players like Carrier and Trane, who are focusing on innovative technologies to meet local demands.

Malaysia : Emerging Market with Potential

Malaysia's rental chiller market is valued at 40.0, reflecting a growing demand for temporary cooling solutions in sectors such as construction and events. The market is driven by increasing urbanization and infrastructure development, supported by government initiatives aimed at enhancing energy efficiency. The competitive landscape includes both local and international players, with a focus on providing cost-effective and efficient cooling solutions.

Thailand : Infrastructure Development Drives Demand

Thailand's rental chiller market is valued at 30.0, with growth driven by infrastructure projects and rising temperatures. The demand for rental chillers is particularly strong in Bangkok and other urban areas, where construction activities are booming. Government initiatives aimed at promoting energy efficiency and sustainability are also shaping the market. The competitive landscape features both local and international players, focusing on innovative solutions to meet growing demand.

Indonesia : Rising Demand in Urban Areas

Indonesia's rental chiller market is valued at 20.0, characterized by increasing demand driven by urbanization and industrial growth. The market is supported by government initiatives aimed at improving infrastructure and energy efficiency. Key cities like Jakarta are witnessing a surge in construction activities, leading to higher demand for rental chillers. The competitive landscape includes both local and international players, focusing on providing efficient cooling solutions.

Rest of APAC : Varied Demand Across Sub-regions

The Rest of APAC rental chiller market is valued at 10.0, encompassing diverse markets with unique demands. Growth is driven by varying factors such as climate, industrialization, and urbanization across different countries. Government policies promoting energy efficiency and sustainability are influencing market dynamics. The competitive landscape features a mix of local and international players, each adapting to the specific needs of their respective markets.