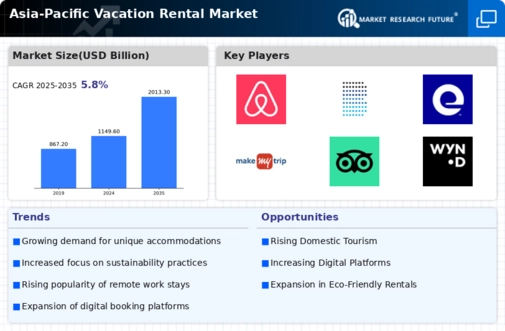

China : Rapid Growth and Urbanization Trends

China holds a commanding market share of 6.5% in the APAC vacation rental sector, driven by urbanization and a burgeoning middle class. Key growth drivers include increased domestic travel, government support for tourism, and a shift towards online booking platforms. Regulatory policies are becoming more favorable, with local governments promoting short-term rentals to boost tourism. Infrastructure improvements, such as high-speed rail and airports, further enhance accessibility to popular destinations.

India : Diverse Offerings and Cultural Richness

India's vacation rental market accounts for 3.2% of the APAC total, fueled by a growing interest in experiential travel and cultural tourism. The rise of digital platforms and increased disposable income among millennials are key growth drivers. Government initiatives like the Incredible India campaign promote domestic tourism, while regulatory frameworks are evolving to accommodate short-term rentals. Infrastructure development, particularly in tier-2 cities, is also enhancing market accessibility.

Japan : Cultural Heritage Meets Modern Demand

Japan's vacation rental market holds a 2.8% share in APAC, characterized by a blend of traditional hospitality and modern rental options. Key growth drivers include the increasing influx of international tourists and the government's push to promote tourism ahead of major events. Regulatory measures, such as the Minpaku Law, have formalized the short-term rental market, ensuring safety and quality. Infrastructure improvements, especially in urban areas, are facilitating easier access to tourist attractions.

South Korea : Smart Solutions for Modern Travelers

South Korea's vacation rental market represents 1.8% of the APAC sector, driven by technological advancements and a strong domestic travel culture. The rise of mobile booking apps and platforms has transformed consumer behavior, making it easier to find and book accommodations. Government initiatives to support tourism and regulatory frameworks that encourage short-term rentals are also contributing to growth. Major cities like Seoul and Busan are key markets, with a competitive landscape featuring both local and international players.

Malaysia : Diverse Destinations and Affordable Options

Malaysia's vacation rental market accounts for 1.0% of the APAC total, benefiting from its diverse cultural landscape and affordability. Key growth drivers include increased international arrivals and a growing preference for unique travel experiences. Government initiatives to promote tourism, along with favorable regulations for short-term rentals, are enhancing market conditions. Key cities like Kuala Lumpur and Penang are emerging as popular destinations, with a mix of local and international players competing for market share.

Thailand : Breathtaking Destinations and Experiences

Thailand's vacation rental market holds a 0.9% share in APAC, heavily influenced by its status as a top tourist destination. The growth is driven by increasing international arrivals and a shift towards personalized travel experiences. Regulatory frameworks are evolving to support short-term rentals, while government initiatives promote tourism. Key markets include Bangkok and Phuket, where major players like Airbnb and local operators are vying for market presence, creating a competitive landscape.

Indonesia : Cultural Richness and Natural Beauty

Indonesia's vacation rental market represents 0.8% of the APAC sector, driven by its rich cultural heritage and stunning landscapes. Key growth drivers include rising domestic tourism and increasing international interest in destinations like Bali. Regulatory policies are gradually adapting to accommodate the growing rental market, while government initiatives promote tourism. Key cities such as Bali and Jakarta are central to the market, with a mix of local and international players enhancing competition.

Rest of APAC : Varied Offerings Across Multiple Regions

The Rest of APAC accounts for a 0.73% share in the vacation rental market, characterized by diverse offerings across various countries. Growth drivers include increasing travel accessibility and a rising interest in unique accommodations. Regulatory environments are varied, with some countries embracing short-term rentals while others impose restrictions. Key markets include emerging tourist destinations in Vietnam and the Philippines, where local and international players are beginning to establish a presence.