Research Methodology on Automated Optical Inspection System Market

INTRODUCTION

This research proposal seeks to provide a comprehensive research methodology for The Automated Optical Inspection System Market. Automated Optical Inspection Systems (AOIS) are highly advanced technologies used for inspecting and detecting a variety of defects on products such as printed circuit boards (PCBs), consumer goods and pharmaceutical products during real-time production.

The core purpose of AOIS is to help in reducing production losses due to quality control processes and improve overall production efficiency. Additionally, AOIS offer several different features, such as the ability to detect and inspect various defects, non-destructive testing and accurate defect detection. AOIS is also used in a variety of industries, such as automotive, aerospace, pharmaceutical, electronics and food & beverage, due to their high accuracy and efficiency.

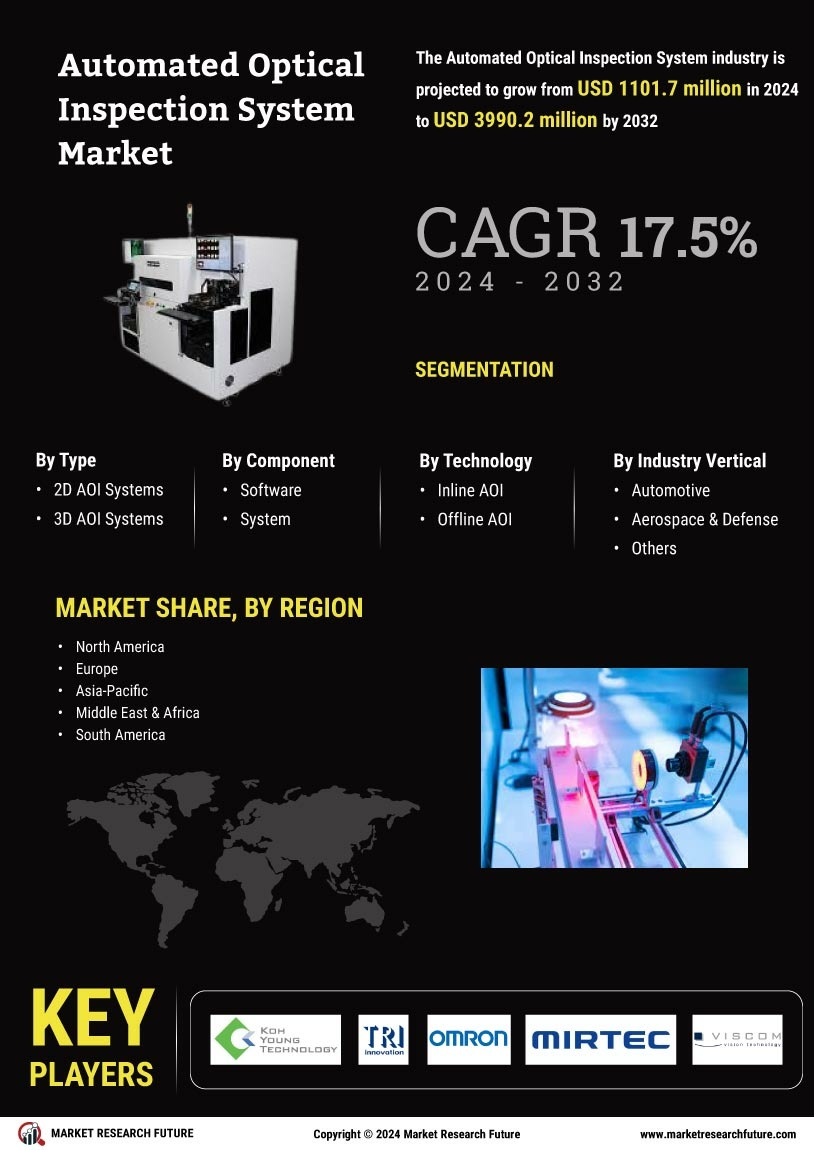

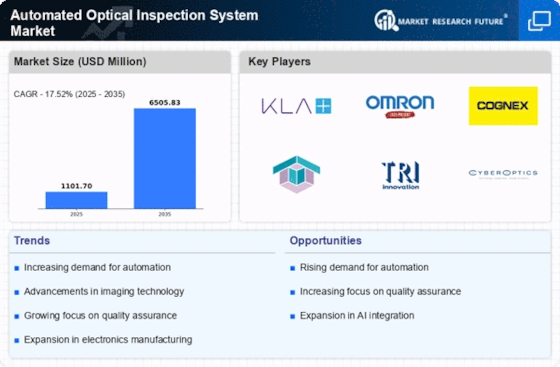

The growth of the said market is attributed to the increasing demand for automated surface inspecting systems, decreasing cost of Automated Optical Inspection Systems, and the ability of AOIS to detect a wide range of packaging defects and inconsistencies. Furthermore, increasing deployment of artificial intelligence (AI) in automated optical inspection systems and increasing innovation in the AOIS technology coupled with continuous integration of new features are also expected to drive the growth of the Automated Optical Inspection Systems market in the near future.

RESEARCH OBJECTIVE

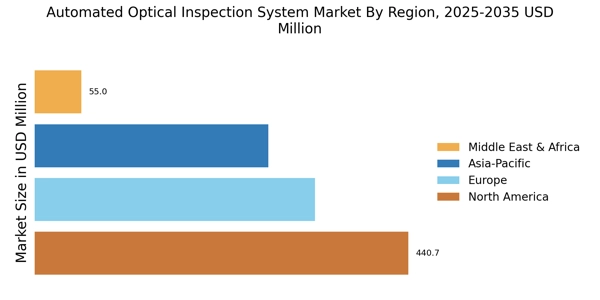

The main objective of this research is to provide a comprehensive research methodology for The Automated Optical Inspection System Market. The research seeks to provide detail on the components, key players, market drivers, and various types of Automated Optical Inspection Systems. In addition, the research also provides an overview of the market size, current trends, and the current competitive landscape of the Automated Optical Inspection Systems market.

RESEARCH METHODOLOGY

The research is conducted through an extensive quantitative and qualitative analysis in order to come up with an accurate and comprehensive research methodology for the Automated Optical Inspection System Market. The following research steps are undertaken in order to complete the research proposal.

Literature Review

The first step in the research methodology is the literature review. The literature review provides an Overview of the Automated Optical Inspection System Market to help understand the current trends in the industry, the various types of Automated Optical Inspection Systems, and the current competitive landscape. A comprehensive literature review helps provide key insights into the current market size, growth, and various drivers and restraints affecting the industry.

Articles, white papers, and news reports related to the Automated Optical Inspection Systems industry are sourced from a variety of sources such as trade journals, industry magazines and online research databases. The literature review allows for the identification of the key players in the industry as well as gain insight into the current competitive landscape of the Automated Optical Inspection Systems industry. This also helps provide an overview of the current trends, drivers and restraints that affect the Automated Optical Inspection Systems industry.

Secondary Research

The second step in the research methodology is secondary research. Secondary research is a vital part of the research process, as it allows for a more in-depth analysis of The Automated Optical Inspection System market. Secondary research is conducted to gain access to data and information already collected by major sources such as the Bureau of Labour Statistics, the Federal Reserve Board and the U.S. Census Bureau. Additional secondary sources such as industry magazines and trade journals, as well as online news portals and blogs, are also used in the secondary research.

Primary Research

The third step in the research methodology is primary research. Primary research is an important part of the research process as it allows for direct engagement with the stakeholders involved in the industry. Primary research is conducted to gain direct feedback and insights from industry-leading Automated Optical Inspection System manufacturers, suppliers and distributors. Interviews, questionnaires and surveys are conducted to gain a better understanding of the current trends and drivers affecting the Automated Optical Inspection System market. Primary research also allows for the formulation of hypotheses and enables the development of strategic recommendations.

Data Analysis

The fourth step in the research methodology is data analysis. Data analysis is crucial for a comprehensive and accurate analysis of the Automated Optical Inspection System market. Data analysis also involves visualizing the data in the form of scatter and trend plots, as well as other forms of graphical presentations, which enables a better understanding of the trend and growth of the Automated Optical Inspection System market.

EXECUTIVE REPORT

The fifth step in the research methodology is the preparation of an executive report. The executive report summarizes the findings from the research proposal and provides strategic recommendations for the Automated Optical Inspection System market. The executive report also provides an analysis of the key players in the Automated Optical Inspection System industry.

CONCLUSION

This research proposal seeks to provide a comprehensive research methodology for The Automated Optical Inspection System Market. The research proposal seeks to provide detail on the components, key players, market drivers, and various types of Automated Optical Inspection Systems.

In addition, the research also provides an overview of the market size, current trends, and the current competitive landscape of the Automated Optical Inspection Systems market. The research methodology is conducted through an extensive literature review, secondary research, primary research, data analysis, and the preparation of an executive report. The proposed research methodology helps to provide an accurate and comprehensive analysis of the Automated Optical Inspection System market.