Integration of Smart Technologies

The integration of smart technologies into vehicles is significantly influencing the Automotive Camera & Camera Module Market. With the advent of connected vehicles, there is a growing need for sophisticated camera systems that can communicate with other vehicle components and external infrastructure. This integration facilitates features such as real-time traffic monitoring, adaptive cruise control, and enhanced navigation systems. The market is expected to witness a substantial increase in demand for cameras that support these smart functionalities, with projections indicating a potential market size expansion to over 20 billion USD by 2028. This trend underscores the importance of technological innovation in shaping the future of automotive safety and convenience.

Regulatory Push for Safety Standards

Regulatory bodies across various regions are increasingly mandating stringent safety standards for vehicles, which is propelling the Automotive Camera & Camera Module Market forward. Governments are implementing regulations that require the installation of advanced camera systems in new vehicles to enhance safety and reduce fatalities. For instance, the European Union has proposed regulations that necessitate the inclusion of rear-view cameras in all new cars. This regulatory push is likely to create a robust demand for automotive cameras, as manufacturers strive to comply with these evolving standards. The anticipated growth in this sector could lead to a market valuation exceeding 15 billion USD by 2027, reflecting the critical role of compliance in driving market dynamics.

Expansion of Aftermarket Camera Solutions

The expansion of aftermarket camera solutions is emerging as a vital driver in the Automotive Camera & Camera Module Market. As vehicle owners seek to enhance their existing vehicles with advanced safety features, the demand for aftermarket camera systems is growing. This trend is particularly pronounced among older vehicle models that lack modern safety technologies. The aftermarket segment is projected to grow significantly, with estimates suggesting a market size increase to approximately 5 billion USD by 2026. This growth reflects the increasing consumer inclination towards upgrading their vehicles with advanced camera systems, thereby enhancing safety and convenience on the road.

Rising Demand for Enhanced Safety Features

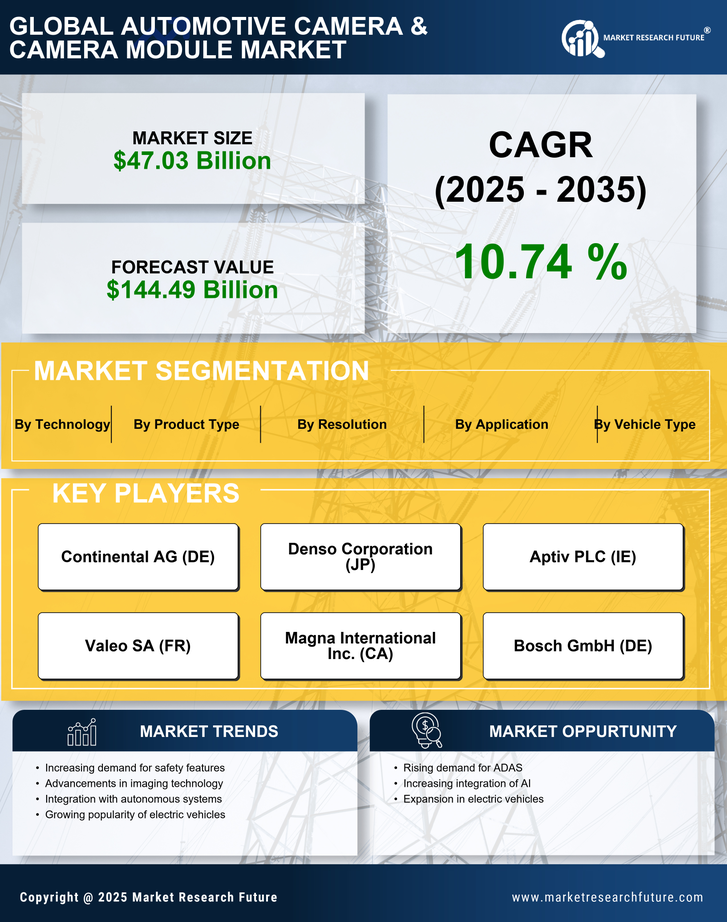

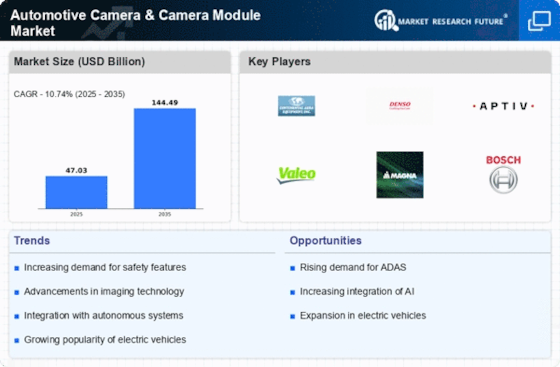

The Automotive Camera & Camera Module Market is experiencing a notable surge in demand for enhanced safety features in vehicles. This trend is largely driven by increasing consumer awareness regarding road safety and the growing number of road accidents. As a result, automotive manufacturers are integrating advanced camera systems to support features such as lane departure warnings, collision avoidance, and parking assistance. According to recent data, the market for automotive cameras is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is indicative of the industry's commitment to improving vehicle safety and reducing accident rates, thereby fostering a more secure driving environment.

Consumer Preference for High-Quality Imaging

Consumer preference for high-quality imaging in automotive applications is a significant driver of the Automotive Camera & Camera Module Market. As consumers become more discerning regarding the performance of their vehicles, the demand for cameras that offer superior image resolution and clarity is on the rise. This trend is particularly evident in the luxury vehicle segment, where high-definition cameras are increasingly being integrated for features such as 360-degree views and night vision capabilities. Market analysis suggests that the demand for high-resolution camera systems could lead to a market growth rate of around 12% annually, as manufacturers seek to meet consumer expectations for enhanced visual performance and safety.