Increase in Vehicle Electrification

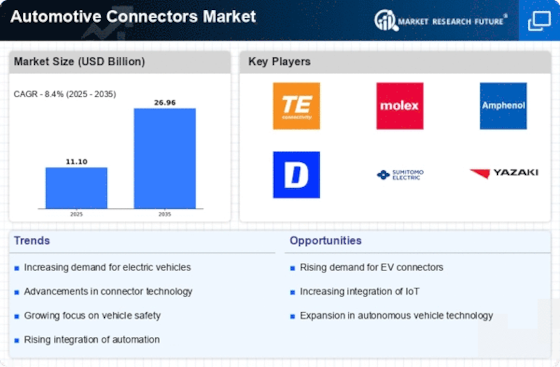

The automotive connectors market is experiencing a notable surge due to the increasing electrification of vehicles. As manufacturers pivot towards electric and hybrid vehicles, the demand for specialized connectors that can handle higher voltages and currents is rising. In 2025, it is estimated that the electric vehicle segment will account for a substantial portion of the automotive market, necessitating advanced connector solutions. These connectors must ensure safety, reliability, and efficiency in power transmission, which is critical for the performance of electric vehicles. Consequently, this trend is likely to drive innovation and investment in the automotive connectors market, as companies strive to meet the evolving needs of the automotive sector.

Rise in Connectivity Features in Vehicles

The automotive connectors market is witnessing a transformation driven by the rise in connectivity features within vehicles. As consumers demand more integrated technology, such as infotainment systems and vehicle-to-everything (V2X) communication, the need for reliable connectors becomes paramount. The market for connected vehicles is expected to grow significantly, with projections indicating that by 2025, nearly 70% of new vehicles will be equipped with some form of connectivity. This trend necessitates the development of connectors that can support high-speed data transmission and withstand various environmental conditions, thereby enhancing the automotive connectors market.

Emphasis on Sustainability and Eco-Friendly Solutions

The automotive connectors market is increasingly shaped by the emphasis on sustainability and eco-friendly solutions. As manufacturers strive to reduce their carbon footprint, there is a growing demand for connectors made from recyclable materials and those that contribute to energy efficiency. This shift is likely to influence product development, with companies focusing on creating connectors that not only meet performance standards but also align with environmental regulations. The market for sustainable automotive components is projected to grow, indicating that the automotive connectors market will need to adapt to these changing consumer preferences and regulatory requirements.

Technological Advancements in Manufacturing Processes

The automotive connectors market is benefiting from technological advancements in manufacturing processes. Innovations such as automation, 3D printing, and advanced materials are enhancing the production efficiency and quality of automotive connectors. These advancements allow manufacturers to produce connectors that are lighter, more durable, and capable of meeting the increasing demands of modern vehicles. As the automotive industry continues to evolve, the integration of these technologies is expected to drive down costs and improve the performance of connectors. This trend is likely to foster competition within the automotive connectors market, as companies seek to leverage these advancements to gain a competitive edge.

Growing Demand for Advanced Driver Assistance Systems (ADAS)

The automotive connectors market is significantly influenced by the growing demand for Advanced Driver Assistance Systems (ADAS). As safety regulations become more stringent, automotive manufacturers are increasingly integrating ADAS features into their vehicles. This integration requires a variety of connectors that facilitate communication between sensors, cameras, and control units. The market for ADAS is projected to expand rapidly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This growth will likely necessitate the development of more sophisticated connectors that can support the complex data requirements of these systems, thereby propelling the automotive connectors market forward.