Rising Safety Regulations

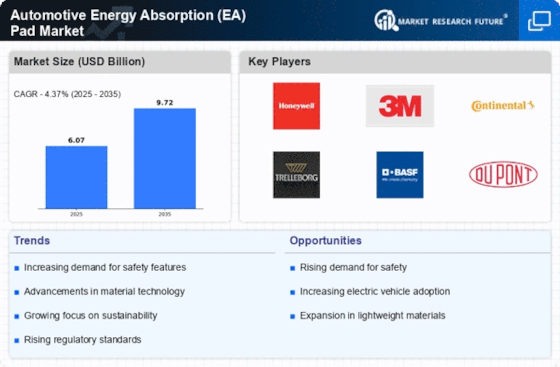

The Automotive Energy Absorption (EA) Pad Market is experiencing a surge in demand due to increasingly stringent safety regulations imposed by various governments. These regulations mandate the incorporation of advanced safety features in vehicles, including energy absorption systems that mitigate impact forces during collisions. As a result, manufacturers are compelled to invest in innovative EA pad technologies to comply with these regulations. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 6% over the next five years, driven by the need for enhanced vehicle safety. This trend indicates a robust opportunity for companies specializing in the development of high-performance EA pads that meet regulatory standards while ensuring passenger safety.

Growth of Electric and Hybrid Vehicles

The Automotive Energy Absorption (EA) Pad Market is poised for growth due to the rising popularity of electric and hybrid vehicles. These vehicles often require specialized energy absorption systems to accommodate their unique structural designs and weight distributions. As the market for electric vehicles is projected to grow at a CAGR of 20% over the next decade, the demand for EA pads tailored to these vehicles is likely to increase correspondingly. Manufacturers are thus focusing on developing EA pads that not only enhance safety but also align with the sustainability goals of electric vehicle production. This trend indicates a promising avenue for growth within the EA pad market.

Increased Investment in Automotive R&D

The Automotive Energy Absorption (EA) Pad Market is benefiting from increased investments in research and development by automotive manufacturers. As companies strive to innovate and improve vehicle safety, they are allocating substantial resources to the development of advanced EA pad technologies. This trend is reflected in the automotive sector's R&D spending, which has seen a rise of approximately 10% in the past year. Such investments are likely to lead to breakthroughs in energy absorption materials and designs, enhancing the overall effectiveness of EA pads. As a result, the market is expected to witness a surge in new product launches and technological advancements, further driving its growth.

Technological Advancements in Materials

The Automotive Energy Absorption (EA) Pad Market is significantly influenced by advancements in material science. The development of new composite materials and polymers enhances the performance of EA pads, allowing for better energy absorption and weight reduction. These innovations not only improve vehicle safety but also contribute to fuel efficiency by reducing overall vehicle weight. The market for advanced materials is expected to reach USD 1.5 billion by 2026, reflecting a growing interest in lightweight and high-performance solutions. As manufacturers seek to differentiate their products, the integration of cutting-edge materials into EA pads is likely to become a key competitive advantage, driving further growth in the industry.

Consumer Demand for Enhanced Vehicle Safety

Consumer awareness regarding vehicle safety is at an all-time high, significantly impacting the Automotive Energy Absorption (EA) Pad Market. As consumers increasingly prioritize safety features when purchasing vehicles, automakers are responding by integrating advanced EA pads into their designs. This shift is evident in the rising sales of vehicles equipped with enhanced safety systems, which have seen a 15% increase in the last year alone. Consequently, manufacturers are focusing on developing EA pads that not only meet safety standards but also appeal to consumer preferences. This growing demand for safety-oriented vehicles is expected to propel the market forward, creating opportunities for innovation and expansion.