September 2023: Modine (NYSE: MOD), a diversified worldwide leader in revolutionary thermal management technology and solutions, made the announcement today that it has signed a formal agreement to sell three Modine companies situated in Germany to affiliates of Regent LP. Additionally, the company said that it has signed the deal. There are three locations where the enterprises may be found: Neuenkirchen, Pliezhausen, and Wackersdorf. It is anticipated that the transaction will be finalized over the next several weeks, provided that regulatory permission is obtained.

"The sale of these businesses is in line with our strategy to focus our resources on high-margin technologies with strong growth drivers," said Neil Brinker, President and Chief Executive Officer of Modine. "We are determined to focus our resources on these technologies." These companies are involved in the production and maintenance of non-strategic components for internal combustion diesel and gasoline engines that are sold in the European automobile industry.

Following closely on the heels of Modine's purchase of Napps Technology, the divestment of these companies exemplifies our unwavering dedication to concentrating on the development of new, engineered solutions that assist us in achieving our long-term profitability objectives and promote our mission of building a world that is cleaner and healthier.

Exhaust gas recirculation coolers, radiators, and charge air cooler modules are some of the products that these companies make for use in automotive applications associated with internal combustion engines in Europe. It was estimated that the overall income from the firms was between $80 and $90 million for the fiscal year 2023.

According to Adrian I. Peace, President of Performance Technologies, "We have made it abundantly clear that Modine's highest priorities for its vehicular businesses are to concentrate on the technologies and systems that add the most value, while at the same time rationalizing product lines that are not strategic." It was not in line with our emphasis on investing in product lines and systems that had significant tailwinds that we decided to purchase exhaust gas recirculation coolers, radiators, and charge air cooler modules for automotive internal combustion engines in Europe.

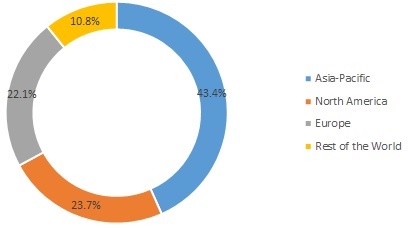

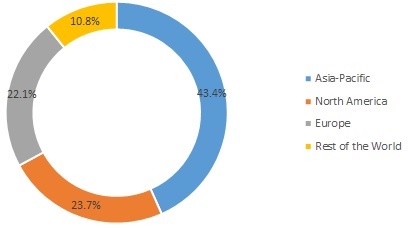

Automotive Exhaust Gas Recirculation Market (EGR) Systems Regional Analysis

On the basis of region, the global automotive exhaust gas recirculation (EGR) systems market is segmented into North America, Europe, Asia-Pacific (APAC), and the rest of the world (RoW).

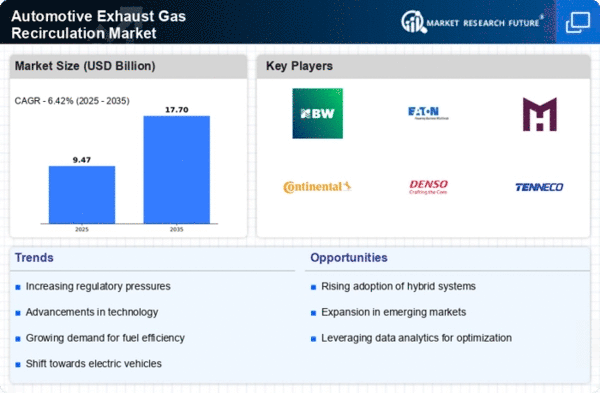

Automotive Exhaust Gas Recirculation Market (EGR) Systems Key Competitors

The key players of the global automotive exhaust gas recirculation (EGR) systems market are Mahle GmbH, Wells Vehicle Electronics, BorgWarner Inc., Combustion Ltd, Delphi ANSYS Inc., DENSO Europe BV, Eberspächer Climate Control Systems GmbH & Co. KG, Friedrich Boysen GmbH & Co. KG, ElringKlinger AG, and IAV GmbH.

Global Automotive Exhaust Gas Recirculation Market (EGR) Systems Market, by Region, 2018

Source: Market Research Future Analysis

The rest of the world (RoW) consists of the Middle East & Africa and South America. The RoW region is projected to witness significant growth in the global automotive exhaust gas recirculation (EGR) systems market during the forecast period due to the growing demand for luxurious vehicles, especially from the MEA region.

Automotive Exhaust Gas Recirculation Market (EGR) Systems Synopsis

The global automotive exhaust gas recirculation (EGR) systems market has been segmented based on product type, application, vehicle type, and region. On the basis of product type, the EGR valve segment is projected to witness significant growth. Segmentation based on application, in 2018, the diesel segment was led the global market. On the basis of vehicle type, the global automotive exhaust gas recirculation (EGR) systems market is segmented into a passenger vehicle, light commercial vehicle, and heavy commercial vehicle.

The passenger car segment is expected to dominate the market due to growing production and sales of cars and SUVs in emerging countries such as China and India. Among the regions, in 2018, the global automotive exhaust gas recirculation (EGR) systems market was led by Asia-Pacific followed by North America and Europe.

Leave a Comment