Automotive Exhaust Gas Recirculation Size

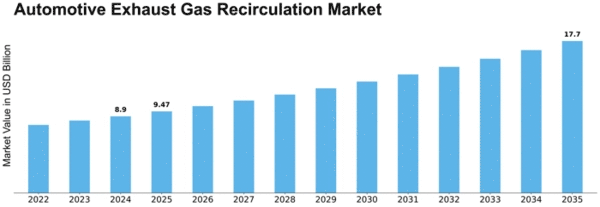

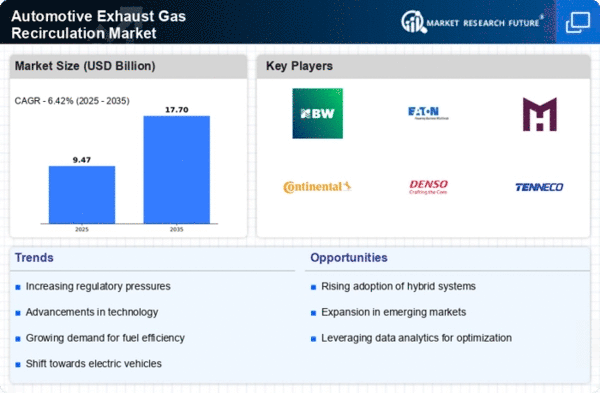

Automotive Exhaust Gas Recirculation Market Growth Projections and Opportunities

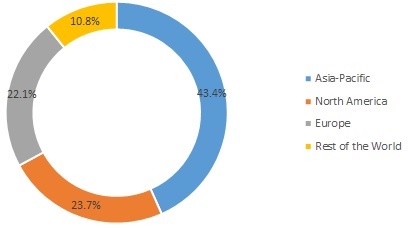

The global market for automotive exhaust gas recirculation (EGR) systems has been growing steadily in recent years and is expected to continue growing in the future. This is because more and more cars are being equipped with EGR systems as a way to reduce pollution and improve fuel efficiency. The market is expected to grow at the same pace during the forecast period, which means it will continue to increase at a steady rate. There are several reasons why the automotive EGR system market looks promising in the future. One of the main driving factors is the booming automotive industry, as more and more people are buying cars and the demand for vehicles is increasing. Additionally, global players in the automotive industry are expanding into emerging nations, which provides new opportunities for the EGR system market. Moreover, with the growing urbanization, there is a greater need for vehicles that are environmentally friendly and comply with emission regulations, which further boosts the demand for EGR systems. One of the major trends in the market is the combination of exhaust gas recirculation (EGR) and selective catalytic reduction (SCR) systems. These two technologies work together to further reduce emissions from vehicles. Another trend is the focus on emerging economies, as these regions are experiencing rapid industrialization and urbanization, leading to increased vehicle production and the need for emission control systems. However, there are also challenges that restrain the market's growth. One challenge is the availability of substitutes, as there may be alternative technologies or solutions that can achieve similar results. Pricing pressure is also a challenge, as customers may be price-sensitive and reluctant to invest in expensive EGR systems. Additionally, strict government regulations for the certification of automotive EGR systems can pose challenges for manufacturers. Despite these challenges, the global market for automotive EGR systems is expected to have a very broad market in the coming years. Analysts have predicted that the passenger car segment alone will be worth USD 19,242.3 million by the year 2023. This indicates the significant growth potential and opportunities in the market.

Leave a Comment