Research Methodology on Automotive Head-Up Display Market

The research methodology used for the report “Automotive Head-Up Display Market” aims to provide a comprehensive understanding of the factors influencing the global automotive head-up display market. Primary sources, such as expert interviews, and surveys along with secondary sources such as analyst reports, company publications and industry databases, are used during the process.

1. Introduction

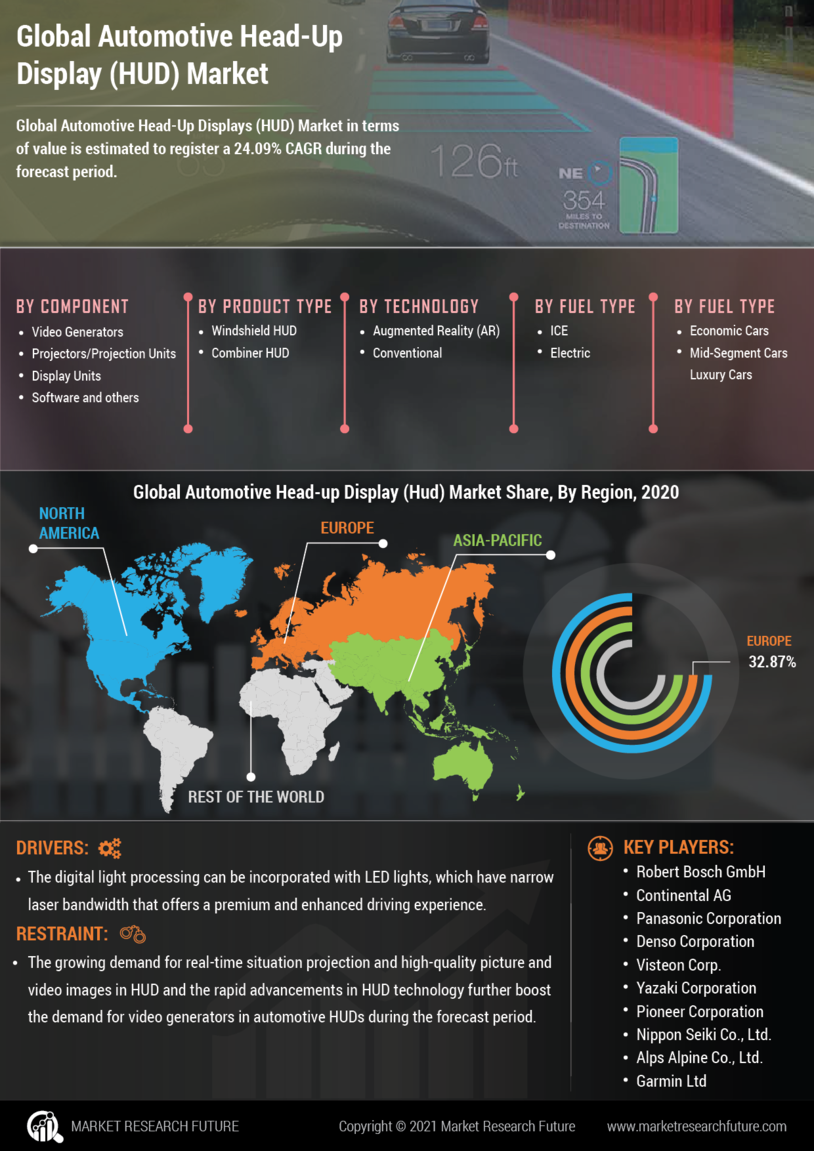

The automotive head-up display (HUD) is an automotive system composed of a visor, software and optics that project the necessary information onto the windshield. It is used to inform drivers of various parameters such as speed and navigation, allowing them to remain focused on the road ahead while accessing important checkpoints during their journey. In this report, the research team studied the market by analyzing the market value and volume decomposition, competitive landscape analysis, market segment analysis and regulatory scenario analysis considering the relevance of the components emerging trends and their implications in the automotive head-up display market.

2. Research Objectives

The research objectives of this report are to:

- Analyze the current market for automotive head-up displays,

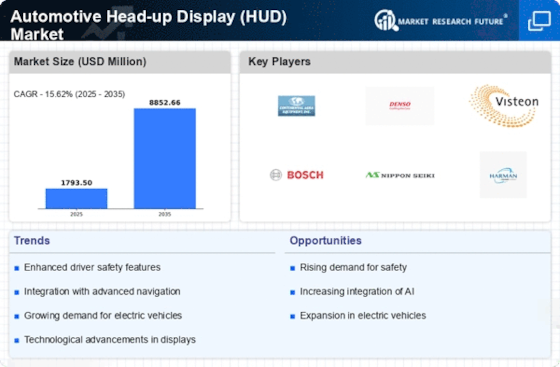

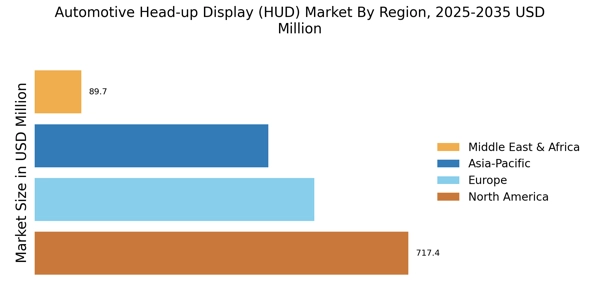

- Estimate the market size and forecast for the global automotive head-up display market from 2023–2030,

- Assess the competitive landscape of the automotive head-up display market,

- Evaluate the market attractiveness and its various segments,

- Analyze the various types of head-up display technologies deployed in the automotive industry,

- Understand the dynamics underlying the automotive head-up display market,

- Identify opportunities and challenges influencing/restraining the growth of the global automotive head-up display market, and

- Provide market intelligence across the automotive head-up display market value chain.

3. Market Definition

The automotive head-up display is defined as the display system that provides drivers with important car-related information without them having to move the view away from the road ahead. This market is segmented into different components, such as type, vehicle type, display size, aftermarket and technology.

4. Research Approach and Methodology

The report uses a combination of primary and secondary research to estimate the size of the automotive head-up display market. Primary research is conducted with a panel of experienced industry experts in order to obtain an in-depth understanding of industry trends, competition and market forces. Secondary research is conducted to ensure that all the information obtained through primary research was validated and verified.

Primary Research:

In order to gain detailed insight from the industry experts, interviews are conducted with key executives from companies, industry experts and stakeholders. These interviews provide insights into the industry-leading trends, competitive landscape and current industry dynamics.

Secondary Research:

The research team conducts a detailed investigation of industry materials, including companies’ annual/quarterly reports and relevant publications. In addition to this, the team built a database of companies associated with the automotive head-up display market, thereby serving as a good source of information. This, coupled with the information gathered from market associations, industry veteran journals, reports and investor presentations, enables the team to come up with the size and forecast of the automotive head-up display market. Furthermore, the market estimates and forecasts for the global automotive head-up display market are studied considering the changing market dynamics and regulatory scenario.

5. Data Triangulation

The following steps are followed in the data triangulation process:

Market measurement comprises the analysis of secondary information to estimate the overall size of the global automotive head-up display market.

The overall size of the automotive head-up display market, in terms of value and volume, is estimated based on reports and research studies published by industry associations, secondary sources, investor presentations, and annual/quarterly reports of companies.

The data triangulation and market breakdown procedures are employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments.

6. Assumptions

In order to complete the report, the research team has made the following assumptions:

- Automotive head-up displays will witness increasing demand from aftermarket as users become more aware of the safety benefits and technology advancements

- Major developments in the technological and product portfolios of key manufacturers to enhance the performance of head-up displays and to ensure customer demands are addressed.