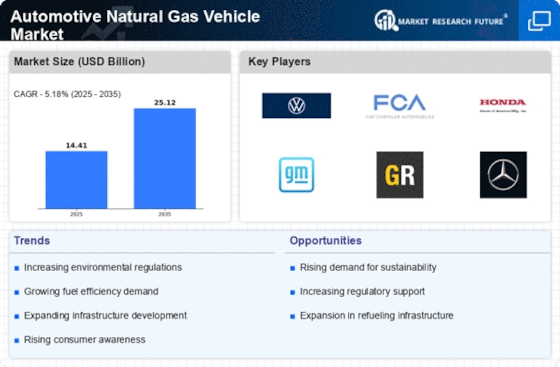

Leading market players are investing heavily in research and development to expand their product lines, which will help the automotive natural gas vehicle market grow even more. Market participants are also undertaking various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The automotive natural gas vehicle industry must offer cost-effective items to expand and survive in a more competitive and rising market climate. Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the global automotive natural gas vehicle industry to benefit clients and increase the market sector. The automotive natural gas vehicle industry has offered some of the most significant advantages in recent years. Major players in the automotive natural gas vehicle industry include Dongfeng Motors Group Limited (China), Beiqi Foton Motors Group Limited (China), AB Volvo (Sweden), Daimler AG (Germany), Shaanxi Automobile Group Limited (China), Landi Renzo (Italy), CNH Industrial NV (The Netherlands), and Westport (Canada). State-owned Chinese automaker

Dongfeng Motor Corporation Ltd. has its headquarters in Wuhan, Hubei. With automobile sales of 5.37 million, 3.50 million, 3.28 million, and 2.30 million in 2021, respectively, it is now the third largest of China's "Big Four" state-owned car manufacturers, which include SAIC Motor, FAW Group, Dongfeng Motor Corporation, and Changan Automobile. Through its subsidiary Dongfeng Motor Group, the firm develops and markets vehicles under its brands, including Venucia, Fengdu, Voyah, Aeolus, and Frothing, as well as under foreign-branded joint ventures, including Dongfeng-Honda, Dongfeng-Nissan, and Dongfeng-Peugeot Citron. 79% of sales in 2021 were made by cars of foreign brands. Under some of the abovementioned brands, including specifically created EV brands like Voyah, it also manufactures electric vehicles. Swedish multinational industrial company, The

Volvo Group, is based in Gothenburg. Volvo offers financial services in addition to manufacturing, distributing, and selling trucks, buses, and construction equipment. It also provides marine and industrial drive systems. With its subsidiary Volvo Trucks, it was the world's second-largest producer of heavy-duty trucks in 2016. Up until 1999, when it was sold to Ford Motor Company, Gothenburg-based Volvo Cars was a subsidiary of AB Volvo. Volvo Cars has been a part of the Geely Holding Group automotive portfolio since 2010. Both AB Volvo and Volvo Cars use the Volvo emblem and work together to maintain the Volvo Museum in Sweden. The company was first listed on the Stockholm Stock Exchange in 1935, and from 1985 to 2007, it was a component of the NASDAQ indexes. Although the ball bearing manufacturer SKF founded Volvo in 1915, the Volvo Group and Volvo Cars considered launching the company's first automobile series, the Volvo V 4, on April 14, 1927, to mark the beginning of their respective histories.

In December 2025, the U.S. administration proposed a sharp rollback of vehicle fuel-economy rules, signaling a major shift in environmental policy. The proposal may reduce regulatory pressure on automakers. However, experts warn it could slow EV adoption and increase emissions.

In September 2025, Cargas Oil saw a 54% surge in sales and converted 258,000 vehicles to natural gas, reflecting rising demand for cleaner-fuel alternatives in transportation. The growth indicates shifting consumer preference toward CNG conversions, driven by cost and environmental factors. It highlights the expanding role of alternative fuel solutions in global auto usage.