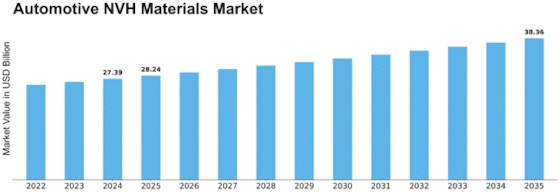

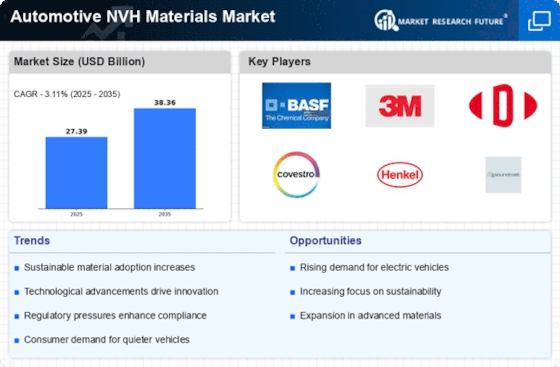

Automotive Nvh Materials Size

Automotive NVH Materials Market Growth Projections and Opportunities

The noise, vibrations, and harshness caused by object movement called NVH. All perceptible vibrations that affect driving comfort are included. Lower noise and vibration improve a vehicle's comfort, performance, and health. When planning new automobiles, automakers prioritize NVH testing and upgrading of the vehicle and its parts.Different factors drive the Automotive NVH (Noise, Vibration, and Harshness) materials market's growth, trends, and competitive landscape. In the automobile industry, NVH materials reduce noise, vibrations, and occupant comfort. Understanding market factors involves studying creative trends, industry expectations for comfort and performance, administrative requirements, financial changes, and cutting-edge methods.

Automotive NVH materials market aspects require mechanical headways. Continuous advances in material science and design have led to the development of advanced NVH materials with high noise retention, vibration damping, and durability. Automakers can choose from particular froths and composites to sound-stifling coatings to increase vehicle comfort and reduce noise and vibrations.

Industry demands for improved comfort and performance drive Automotive NVH materials market factors. Automakers are prioritizing NVH improvements due to rising customer demand for smoother rides. As the automotive industry integrates electric vehicles (EVs) and advanced powertrains, the demand for NVH materials to address their unique noise and vibration patterns grows.

Administrative norms and consistency affect Automotive NVH materials market aspects. Emissions, noise, and safety requirements imposed by government and industry groups affect NVH material acceptance. These criteria ensure that NVH materials fulfill well-being standards and improve vehicle performance without sacrificing administrative requirements.

Additionally, key players' aggressive practices affect the Automotive NVH materials market. Extreme competition among material providers pushes new effort to create and deliver NVH materials with improved performance, solidity, and affordability. Joint endeavors, organizations, and acquisitions are common ways to increase market reach, provide additional NVH arrangements, and gain an edge.

Vehicle design trends like lightweighting and option powertrains also effect market considerations. As manufacturers design lighter vehicles without compromising safety or comfort, demand for innovative NVH materials that reduce weight and regulate noise and vibration rises.

Leave a Comment