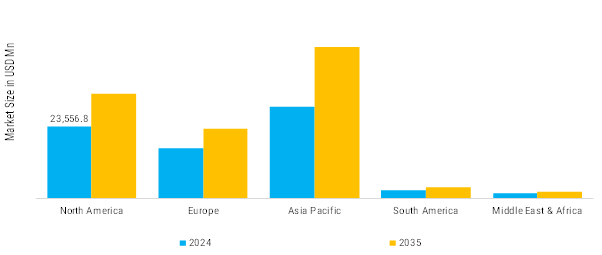

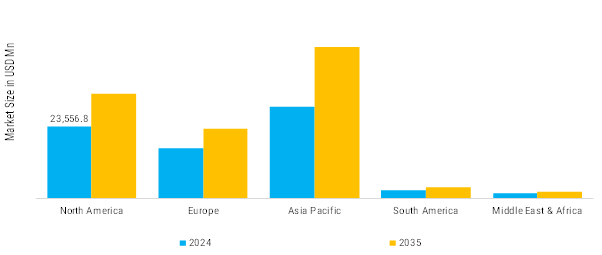

North America: Increased automotive seating systems and components

North American market for automotive seating systems and components is characterized by strong demand for comfort, safety, and advanced features, particularly in SUVs, pickup trucks, and premium vehicles, which dominate the region's vehicle sales. Consumers in the U.S. and Canada tend to prioritize luxury seating features such as power adjustability, heated and ventilated seats, memory functions, and premium upholstery materials like genuine leather or high-quality synthetic alternatives. North America’s large aftermarket sector supports demand for seat upgrades and replacements, especially for trucks and older vehicles. Brands like Recaro offer performance seats, while companies like Katzkin specialize in premium aftermarket leather upholstery upgrades, which are popular among truck and SUV owner.

Europe: Emerging automotive seating systems and components

The European market for automotive seating systems and components is driven by a strong emphasis on premium comfort, sustainability, safety, and cutting-edge design. European consumers value ergonomic design and environmentally friendly materials, while regulations related to safety and emissions influence both seat construction and materials. Automakers in Europe are actively pushing for lightweight, sustainable, and tech-integrated seating solutions across both internal combustion engine (ICE) and electric vehicles (EVs).

Asia-Pacific: Rapidly Growing automotive seating systems and components

The Asia-Pacific (APAC) region is the largest and fastest-growing market for automotive seating systems and components, driven by massive vehicle production volumes, rising disposable income, and rapid urbanization in countries like China, India, Japan, and South Korea. The market here is highly diverse ranging from high-volume economy vehicles to luxury sedans and electric vehicles all of which demand different seating solutions in terms of cost, design, and features. For example, the NIO ES8, a premium Chinese electric SUV, features zero-gravity seats with heating, ventilation, and massage functions. Similarly, XPeng’s G9 integrates smart seating with memory and climate control, showcasing the region’s push toward high-tech, comfort-enhancing features even in mid-to-high-end segments.

Middle East and Africa: Emerging automotive seating

The Middle East & Africa (MEA) region presents a unique automotive seating market shaped by extremes in climate, a growing preference for SUVs and luxury vehicles, and rising urbanization in key countries such as Saudi Arabia, UAE, South Africa, and Egypt. While overall vehicle production in the region is lower compared to Asia or North America, the demand for high-durability and climate-adaptive seating systems is steadily growing particularly in premium vehicles, fleet operations, and off-road SUVs. In the Middle East, consumers place strong emphasis on comfort and luxury, which is reflected in high demand for leather-trimmed, ventilated, and power-adjustable seats. For example, the Toyota Land Cruiser, a highly popular SUV across Saudi Arabia and the UAE, offers ventilated leather seats, power recline, and memory settings in upper trims essential for driving comfort in hot desert environments.

South America: Rapidly Develop automotive seating

The South American market for automotive seating systems and components is steadily growing, driven primarily by demand for affordable, durable, and functional seats in entry- to mid-level passenger vehicles. Key markets such as Brazil and Argentina serve as regional automotive manufacturing hubs, with major OEMs like Volkswagen, Chevrolet (GM), Fiat (Stellantis), and Renault producing vehicles locally to meet the price-sensitive demands of consumers. In this region, cost efficiency and durability are top priorities. However, higher trim levels are beginning to offer synthetic leather upholstery, manual lumbar support, and basic comfort enhancements to meet rising consumer expectations.