Increasing Focus on Safety Standards

The Automotive Stainless Steel Tube Market is significantly influenced by the increasing focus on safety standards in vehicle manufacturing. Regulatory bodies are continuously updating safety regulations, necessitating the use of robust materials that can withstand high-impact scenarios. Stainless steel tubes are recognized for their superior strength and ability to enhance vehicle safety features, such as crumple zones and roll cages. As manufacturers comply with these evolving safety standards, the demand for stainless steel tubes is likely to rise, thereby benefiting the Automotive Stainless Steel Tube Market. This trend underscores the importance of material selection in meeting both regulatory requirements and consumer expectations.

Growth in Electric Vehicle Production

The Automotive Stainless Steel Tube Market is poised for growth due to the surge in electric vehicle (EV) production. As automakers pivot towards electric mobility, the demand for high-performance materials, including stainless steel tubes, is expected to increase. These tubes are essential in various components of EVs, such as battery enclosures and structural frames, due to their durability and resistance to corrosion. Recent projections indicate that the EV market could reach a production volume of over 30 million units by 2030, creating substantial opportunities for the Automotive Stainless Steel Tube Market to expand in tandem with this burgeoning sector.

Rising Demand for Lightweight Materials

The Automotive Stainless Steel Tube Market is experiencing a notable increase in demand for lightweight materials. This trend is primarily driven by the automotive sector's ongoing efforts to enhance fuel efficiency and reduce emissions. Stainless steel tubes, known for their strength-to-weight ratio, are increasingly favored in vehicle manufacturing. According to recent data, the use of lightweight materials in vehicles can lead to a reduction in weight by up to 20%, which directly correlates with improved fuel economy. As manufacturers strive to meet stringent environmental regulations, the adoption of stainless steel tubes is likely to rise, thereby propelling the Automotive Stainless Steel Tube Market forward.

Expansion of Automotive Production Facilities

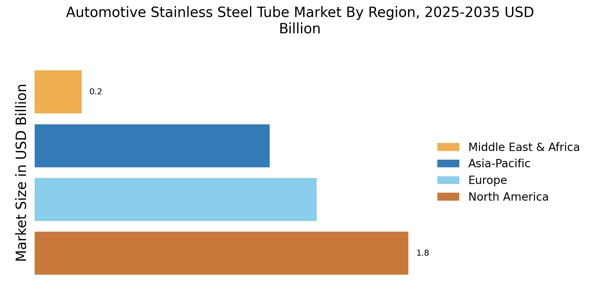

The Automotive Stainless Steel Tube Market is benefiting from the expansion of automotive production facilities across various regions. As manufacturers seek to increase their output to meet rising consumer demand, the need for high-quality materials, including stainless steel tubes, becomes paramount. This expansion is often accompanied by investments in advanced manufacturing technologies, which further enhance the quality and efficiency of production. Recent data suggests that the automotive industry is projected to grow at a compound annual growth rate of approximately 4% over the next five years. This growth trajectory is likely to bolster the Automotive Stainless Steel Tube Market, as manufacturers increasingly rely on stainless steel tubes for their structural and functional applications.

Technological Innovations in Manufacturing Processes

The Automotive Stainless Steel Tube Market is witnessing a wave of technological innovations in manufacturing processes. Advancements such as automated welding and precision machining are enhancing the efficiency and quality of stainless steel tube production. These innovations not only reduce production costs but also improve the overall performance of the tubes, making them more appealing to automotive manufacturers. As the industry embraces these technologies, the Automotive Stainless Steel Tube Market is expected to experience increased competitiveness and growth. Furthermore, the integration of smart manufacturing techniques may lead to more sustainable practices, aligning with the industry's broader goals of reducing environmental impact.