Rising Cybersecurity Threats

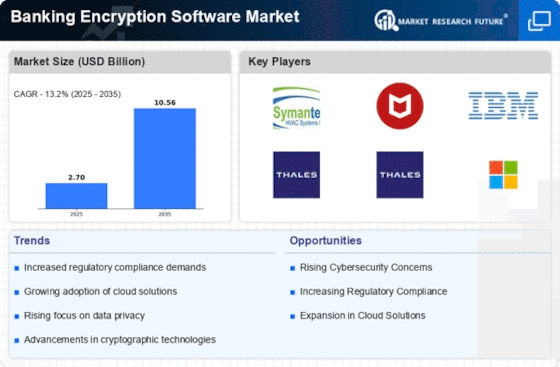

The Banking Encryption Software Market is significantly shaped by the escalating frequency and sophistication of cyber threats targeting financial institutions. Cybercriminals are increasingly employing advanced techniques to breach security systems, leading to substantial financial losses and reputational damage. In response, banks and financial service providers are prioritizing the deployment of encryption software to protect sensitive data from unauthorized access. The market is projected to grow at a compound annual growth rate (CAGR) of around 12% over the next five years, driven by the urgent need for enhanced security measures. This trend underscores the critical role of encryption in mitigating risks associated with data breaches and cyberattacks.

Regulatory Compliance Pressure

The Banking Encryption Software Market is increasingly influenced by stringent regulatory frameworks that mandate robust data protection measures. Financial institutions are compelled to comply with regulations such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). These regulations necessitate the implementation of advanced encryption solutions to safeguard sensitive customer information. As a result, the demand for banking encryption software is projected to grow, with the market expected to reach a valuation of approximately 5 billion dollars by 2026. This compliance pressure not only drives the adoption of encryption technologies but also encourages innovation within the industry, as firms seek to enhance their security postures.

Consumer Awareness of Data Privacy

The Banking Encryption Software Market is also being driven by heightened consumer awareness regarding data privacy and security. As individuals become more informed about the risks associated with data breaches, they are increasingly demanding that financial institutions implement stringent security measures, including robust encryption solutions. This shift in consumer expectations is prompting banks to prioritize the adoption of advanced encryption technologies to safeguard personal information. Market Research Future indicates that approximately 70% of consumers are willing to switch banks if their current institution fails to demonstrate adequate data protection measures. This growing emphasis on data privacy is likely to fuel the demand for banking encryption software, as institutions strive to enhance their security frameworks and retain customer loyalty.

Increased Digital Banking Adoption

The Banking Encryption Software Market is significantly influenced by the accelerated adoption of digital banking services. As consumers increasingly prefer online and mobile banking platforms, the volume of sensitive transactions has surged, necessitating robust encryption solutions to protect user data. This trend is reflected in the projected growth of the digital banking sector, which is expected to reach a market size of over 10 trillion dollars by 2025. Consequently, financial institutions are investing heavily in encryption technologies to ensure secure transactions and maintain customer trust. The rising demand for seamless and secure digital banking experiences is likely to propel the growth of the banking encryption software market in the coming years.

Technological Advancements in Encryption

The Banking Encryption Software Market is experiencing a transformative phase due to rapid technological advancements in encryption methodologies. Innovations such as quantum encryption and blockchain technology are reshaping the landscape, offering unprecedented levels of security for financial transactions. As these technologies mature, they are likely to be integrated into existing banking encryption solutions, enhancing their effectiveness. The market is anticipated to witness a surge in demand as institutions seek to leverage these advancements to stay ahead of potential threats. Furthermore, the integration of artificial intelligence and machine learning into encryption software is expected to optimize security protocols, making them more adaptive and resilient against evolving cyber threats.