Data Privacy Regulations

The encryption software market in France is significantly influenced by stringent data privacy regulations. The implementation of the General Data Protection Regulation (GDPR) has compelled organizations to adopt encryption measures to protect personal data. Non-compliance with these regulations can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. As a result, businesses are increasingly investing in encryption software to ensure compliance and avoid penalties. This regulatory landscape creates a favorable environment for the encryption software market, as organizations recognize the necessity of encryption in their data protection strategies.

Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in France is creating new challenges for data security, thereby impacting the encryption software market. As IoT devices become more integrated into everyday life, the volume of data generated increases, necessitating effective encryption solutions to protect this information. It is projected that by 2025, there will be over 50 billion connected IoT devices globally, many of which will be utilized in France. This growth presents opportunities for the encryption software market, as organizations seek to implement encryption measures to secure data transmitted between IoT devices and central systems.

Increased Cloud Adoption

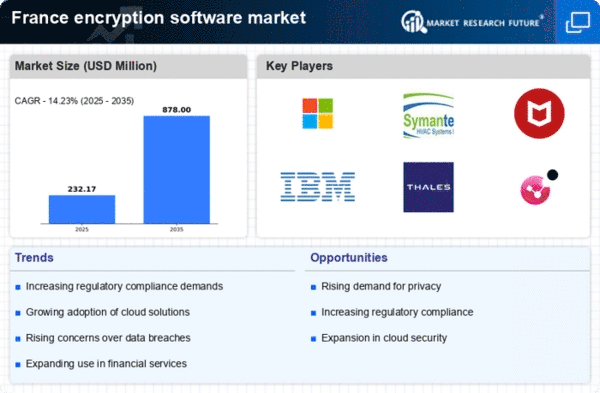

The shift towards cloud computing in France is driving the encryption software market. As more businesses migrate their operations to the cloud, the need for secure data transmission and storage becomes paramount. According to recent studies, approximately 70% of French companies are expected to adopt cloud services by 2025. This trend necessitates the implementation of encryption solutions to protect sensitive data stored in cloud environments. The encryption software market is likely to see substantial growth as organizations seek to secure their cloud-based assets, ensuring that data remains confidential and protected from unauthorized access.

Rising Cybersecurity Threats

The encryption software market in France is experiencing growth due to the increasing frequency and sophistication of cyber threats. As organizations face a surge in data breaches and ransomware attacks, the demand for robust encryption solutions has intensified. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting French businesses to prioritize data protection. This heightened awareness of cybersecurity risks drives investments in encryption technologies, as companies seek to safeguard sensitive information and maintain customer trust. The encryption software market is thus positioned to benefit from this trend, as organizations look for comprehensive solutions to mitigate potential threats.

Growing Demand for Mobile Security

The rise of mobile devices in France has led to an increased demand for encryption software. With the proliferation of smartphones and tablets, sensitive information is often accessed and transmitted via mobile applications. This trend raises concerns about data security, as mobile devices are more susceptible to theft and hacking. In response, the encryption software market is witnessing a surge in demand for mobile encryption solutions. Organizations are investing in technologies that secure data on mobile devices, ensuring that confidential information remains protected, even in the event of device loss or theft.