Growing Adoption of Remote Work

The shift towards remote work in Japan has created a pressing need for secure communication and data sharing. As employees access corporate networks from various locations, the encryption software market in Japan is likely to benefit from the heightened demand for secure remote access solutions. In 2025, it is estimated that around 30% of the Japanese workforce will continue to work remotely, necessitating robust encryption measures to protect sensitive information. Organizations are increasingly investing in encryption technologies to ensure secure connections and data integrity, which may lead to a substantial increase in market growth. This trend underscores the importance of encryption software in maintaining security in a decentralized work environment.

Increasing Cybersecurity Threats

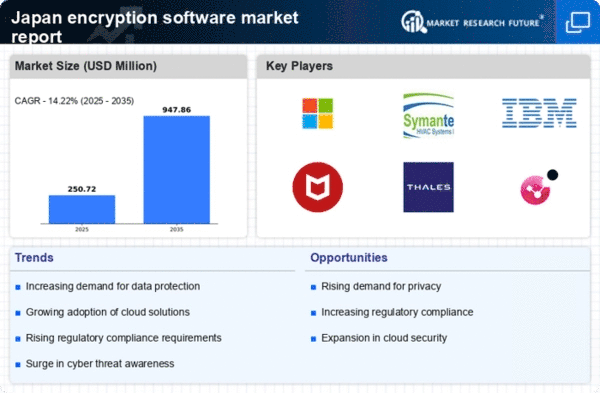

The encryption software market in Japan in Japan is experiencing growth due to the rising frequency and sophistication of cyberattacks. Organizations are increasingly recognizing the necessity of robust data protection measures to safeguard sensitive information. In 2025, it is estimated that cybercrime could cost the Japanese economy over $1 trillion, highlighting the urgency for effective encryption solutions. As businesses face threats from ransomware, phishing, and data breaches, the demand for encryption software is likely to surge. This trend is further supported by government initiatives aimed at enhancing cybersecurity frameworks, which may drive investments in encryption technologies. Consequently, the encryption software market is positioned to expand as companies prioritize securing their digital assets against evolving threats.

Rising Awareness of Data Privacy

In Japan, there is a growing awareness of data privacy among consumers and businesses alike, which is significantly impacting the encryption software market in Japan. As individuals become more conscious of their personal data rights, organizations are compelled to adopt encryption solutions to build trust and ensure compliance with privacy standards. Surveys indicate that over 70% of Japanese consumers are concerned about data breaches, prompting companies to prioritize data protection strategies. This heightened awareness is likely to drive investments in encryption technologies, as businesses seek to enhance their security posture and protect customer information. Consequently, the encryption software market is expected to expand as organizations respond to the increasing demand for data privacy.

Regulatory Compliance Requirements

Japan's encryption software market in Japan is significantly influenced by stringent regulatory compliance requirements. The Personal Information Protection Act (PIPA) mandates that organizations implement adequate security measures to protect personal data. As companies strive to comply with these regulations, the adoption of encryption software becomes essential. In 2025, it is projected that compliance-related investments in cybersecurity will reach approximately $2 billion in Japan. This regulatory landscape compels businesses to adopt encryption solutions to avoid hefty fines and reputational damage. Furthermore, the increasing focus on data privacy and protection laws globally may encourage Japanese firms to enhance their encryption capabilities, thereby driving growth in the encryption software market.

Technological Advancements in Encryption

The encryption software market in Japan in Japan is poised for growth due to rapid technological advancements. Innovations such as quantum encryption and blockchain technology are reshaping the landscape of data security. These advancements offer enhanced security features that appeal to organizations seeking to protect their data against emerging threats. In 2025, the market for quantum encryption is expected to grow by over 25%, indicating a shift towards more sophisticated encryption solutions. As businesses become aware of the potential vulnerabilities in traditional encryption methods, the demand for cutting-edge technologies is likely to increase. This trend suggests that the encryption software market will continue to evolve, driven by the need for advanced security measures.