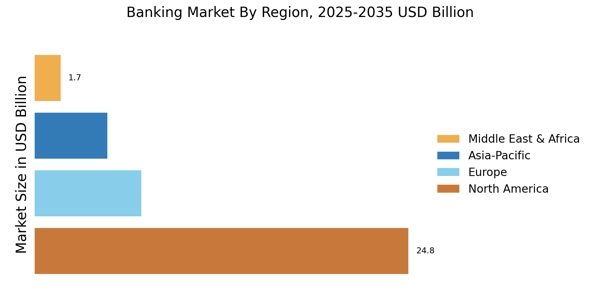

North America : Financial Powerhouse

North America remains the largest banking market globally, driven by robust economic growth, technological advancements, and a strong regulatory framework. The U.S. holds approximately 70% of the market share, with Canada following at around 15%. Regulatory catalysts, such as the Dodd-Frank Act, continue to shape the landscape, ensuring stability and consumer protection. Demand for digital banking solutions is surging, reflecting changing consumer preferences and technological innovations. The competitive landscape is dominated by major players like JPMorgan Chase, Bank of America, and Wells Fargo, which collectively account for a significant portion of the market. These institutions are investing heavily in fintech partnerships and digital transformation to enhance customer experience. The presence of strong regulatory bodies, such as the Federal Reserve, ensures a stable environment for banking operations, fostering innovation and competition among banks.

Europe : Regulatory Innovation Hub

Europe's banking market is characterized by stringent regulations and a push towards digitalization, with the European Union's PSD2 directive driving competition and innovation. Germany and the UK are the largest markets, holding approximately 30% and 25% of the market share, respectively. The region is witnessing a shift towards sustainable finance, with regulations promoting green banking initiatives. The demand for personalized banking services is also on the rise, influenced by changing consumer expectations. Leading countries like Germany, France, and the UK host major banks such as Deutsche Bank, BNP Paribas, and HSBC. The competitive landscape is increasingly influenced by fintech companies, which are challenging traditional banks by offering innovative solutions. The European Central Bank plays a crucial role in maintaining financial stability and fostering a competitive environment, ensuring that banks adapt to the evolving market dynamics.

Asia-Pacific : Emerging Market Dynamics

The Asia-Pacific region is witnessing rapid growth in the banking sector, driven by increasing urbanization, rising incomes, and a growing middle class. China and India are the largest markets, accounting for approximately 40% and 15% of the market share, respectively. Regulatory reforms aimed at enhancing financial inclusion and consumer protection are catalyzing growth. The demand for digital banking services is soaring, with consumers increasingly favoring online and mobile banking solutions. Countries like China, Japan, and India are home to key players such as ICBC, Mitsubishi UFJ, and State Bank of India. The competitive landscape is marked by a mix of traditional banks and emerging fintech companies, which are reshaping the banking experience. Governments are actively promoting digital finance initiatives, ensuring that the banking sector remains agile and responsive to consumer needs, thereby fostering a vibrant financial ecosystem.

Middle East and Africa : Resource-Rich Banking Sector

The Middle East and Africa region is characterized by a diverse banking landscape, with significant growth opportunities driven by economic diversification and investment in infrastructure. The UAE and South Africa are the largest markets, holding approximately 25% and 20% of the market share, respectively. Regulatory frameworks are evolving to support financial inclusion and innovation, with a focus on enhancing consumer protection and fostering competition. The demand for digital banking solutions is increasing, reflecting a shift in consumer behavior towards convenience and accessibility. Leading countries like the UAE, South Africa, and Nigeria host major banks such as Emirates NBD, Standard Bank, and First Bank of Nigeria. The competitive landscape is increasingly influenced by fintech startups, which are challenging traditional banking models. Governments are actively promoting initiatives to enhance the banking sector's resilience and adaptability, ensuring that it meets the needs of a rapidly changing market.