Barcode Label Printer Market Summary

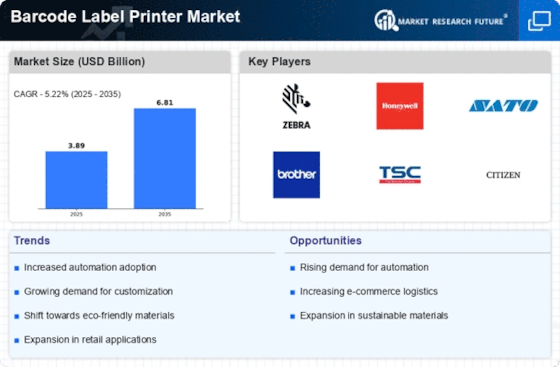

As per Market Research Future analysis, the Barcode Label Printer Market Size was estimated at 3.89 USD Billion in 2024. The Barcode Label Printer industry is projected to grow from 4.093 USD Billion in 2025 to 6.808 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.22% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Barcode Label Printer Market is experiencing robust growth driven by technological advancements and increasing demand for efficient inventory management.

- Technological advancements are enhancing the capabilities of barcode label printers, leading to improved efficiency and functionality.

- Sustainability initiatives are becoming increasingly important, prompting manufacturers to develop eco-friendly printing solutions.

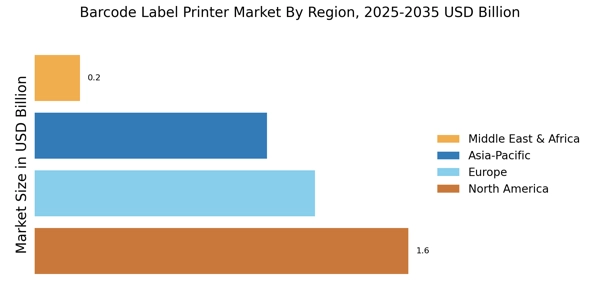

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for barcode label printers.

- The rising demand for efficient inventory management and the expansion of e-commerce are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 3.89 (USD Billion) |

| 2035 Market Size | 6.808 (USD Billion) |

| CAGR (2025 - 2035) | 5.22% |

Major Players

Zebra Technologies (US), Honeywell (US), SATO Holdings (JP), Brother Industries (JP), TSC Auto ID Technology (TW), Citizen Systems (JP), Dymo (US), Primera Technology (US), Avery Dennison (US)