Growth of E-commerce Platforms

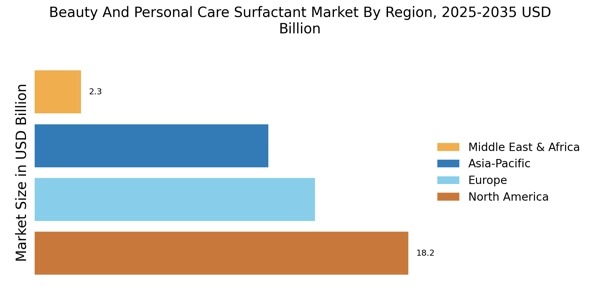

The Beauty And Personal Care Surfactant Market is benefiting from the rapid expansion of e-commerce platforms. As consumers increasingly turn to online shopping for their beauty and personal care needs, manufacturers are adapting their distribution strategies to capitalize on this trend. E-commerce provides a convenient avenue for consumers to access a wider range of products, including those containing surfactants. Recent statistics indicate that online sales in the beauty sector have surged, with e-commerce expected to represent a substantial portion of total sales in the coming years. This shift not only enhances market accessibility but also encourages brands to engage in direct-to-consumer strategies, thereby influencing surfactant demand.

Innovation in Product Formulations

The Beauty And Personal Care Surfactant Market is characterized by continuous innovation in product formulations. Manufacturers are increasingly focusing on developing multifunctional surfactants that offer enhanced performance while meeting consumer demands for safety and efficacy. This trend is driven by the need for products that not only cleanse but also provide additional benefits such as moisturizing and skin conditioning. Market analysis suggests that the introduction of innovative surfactants is likely to propel market growth, with an estimated increase in market size by 5% over the next few years. This emphasis on innovation is crucial for brands aiming to differentiate themselves in a competitive landscape.

Increased Focus on Personal Hygiene

The Beauty And Personal Care Surfactant Market is experiencing heightened attention towards personal hygiene products. The rising awareness of health and wellness has led to an increase in the consumption of personal care items such as hand sanitizers, body washes, and facial cleansers. This trend is particularly evident in regions where hygiene practices are being emphasized more than ever. Market data indicates that the personal care segment is expected to account for a significant share of the surfactant market, with projections suggesting a growth rate of around 6% annually. This focus on hygiene is likely to drive innovation in surfactant formulations, catering to the evolving needs of consumers.

Rising Demand for Natural Ingredients

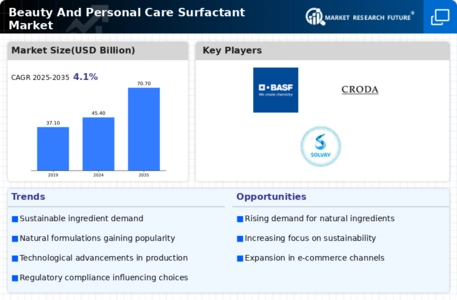

The Beauty And Personal Care Surfactant Market is witnessing a notable shift towards natural and organic ingredients. Consumers are increasingly seeking products that are free from synthetic chemicals, which has led to a surge in demand for surfactants derived from natural sources. This trend is supported by a growing awareness of the potential health risks associated with synthetic additives. According to recent data, the market for natural surfactants is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This shift not only reflects changing consumer preferences but also encourages manufacturers to innovate and develop new formulations that align with these demands.

Regulatory Support for Sustainable Practices

The Beauty And Personal Care Surfactant Market is influenced by regulatory frameworks that promote sustainable practices. Governments and regulatory bodies are increasingly implementing guidelines that encourage the use of eco-friendly surfactants and discourage harmful chemicals. This regulatory support is fostering a more sustainable approach within the industry, prompting manufacturers to reformulate products in compliance with these standards. Data indicates that the market for sustainable surfactants is expected to grow significantly, with projections suggesting a rise of approximately 7% in the next five years. This regulatory environment not only enhances consumer trust but also drives innovation towards greener alternatives.

.png)