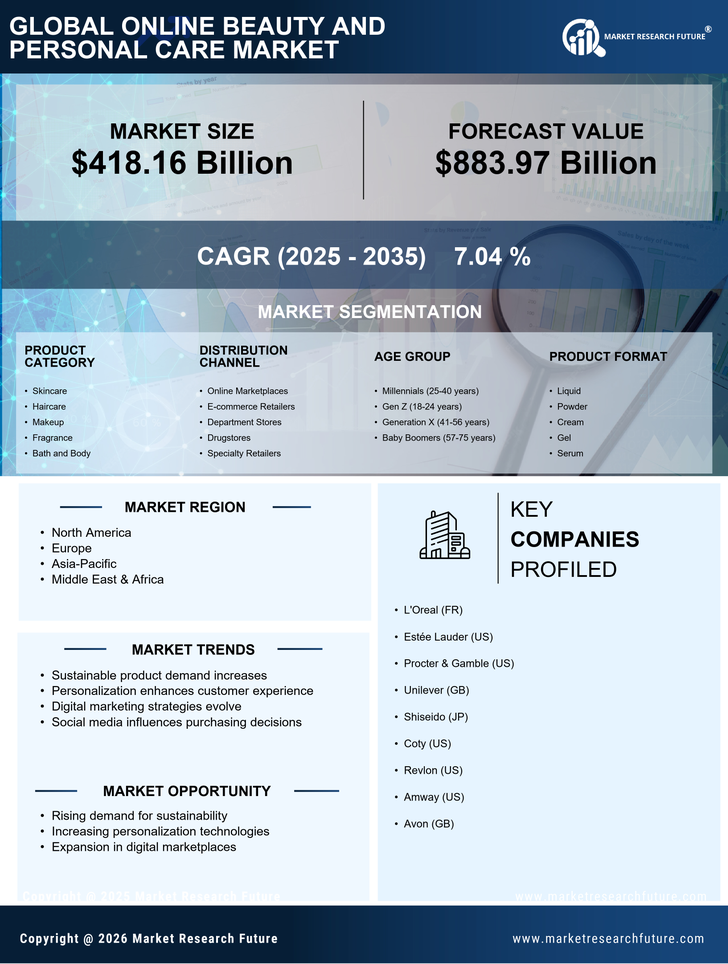

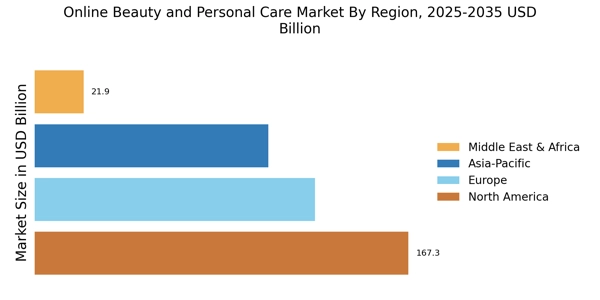

North America : Digital Innovation Leader

North America is the largest market for online beauty and personal care, holding approximately 40% of the global market share. The region's growth is driven by increasing consumer preference for online shopping, innovative digital marketing strategies, and a robust logistics network. Regulatory support for e-commerce and consumer protection laws further catalyze market expansion, making it a dynamic landscape for beauty brands. The United States leads the market, followed by Canada, with major players like Estée Lauder, Procter & Gamble, and Coty dominating the competitive landscape. The presence of established brands and a growing number of niche players contribute to a vibrant market. The rise of social media influencers and personalized shopping experiences are also shaping consumer behavior, enhancing brand loyalty and engagement.

Europe : Diverse Market Dynamics

Europe is the second-largest market for online beauty and personal care, accounting for around 30% of the global market share. The region's growth is fueled by a strong emphasis on sustainability, with consumers increasingly seeking eco-friendly products. Regulatory frameworks, such as the EU Cosmetics Regulation, promote safety and transparency, further driving consumer trust and market growth. Leading countries include Germany, France, and the UK, where brands like L'Oreal and Unilever are prominent. The competitive landscape is characterized by a mix of established brands and innovative startups focusing on clean beauty. E-commerce platforms are evolving, with a significant shift towards mobile shopping, enhancing accessibility and convenience for consumers.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is witnessing rapid growth in the online beauty and personal care market, holding approximately 25% of the global market share. The region's expansion is driven by increasing internet penetration, a young population, and rising disposable incomes. Regulatory initiatives aimed at enhancing product safety and consumer awareness are also contributing to market growth, making it a key player in the global landscape. China and Japan are the leading markets, with significant contributions from South Korea and India. Major players like Shiseido and Amway are capitalizing on the growing demand for beauty products. The competitive landscape is vibrant, with local brands gaining traction alongside international giants, driven by innovative marketing strategies and a focus on digital engagement.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is emerging as a significant player in the online beauty and personal care market, holding about 5% of the global market share. The growth is driven by increasing internet access, a young demographic, and a rising middle class. Regulatory frameworks are evolving to support e-commerce, enhancing consumer protection and product safety, which are crucial for market expansion. Countries like the UAE and South Africa are leading the market, with a growing number of local and international brands entering the space. The competitive landscape is characterized by a mix of traditional retailers and online platforms, with brands like Avon and Revlon making notable inroads. The region's unique cultural diversity also influences product offerings, creating opportunities for tailored marketing strategies.