Growing Focus on Fuel Efficiency

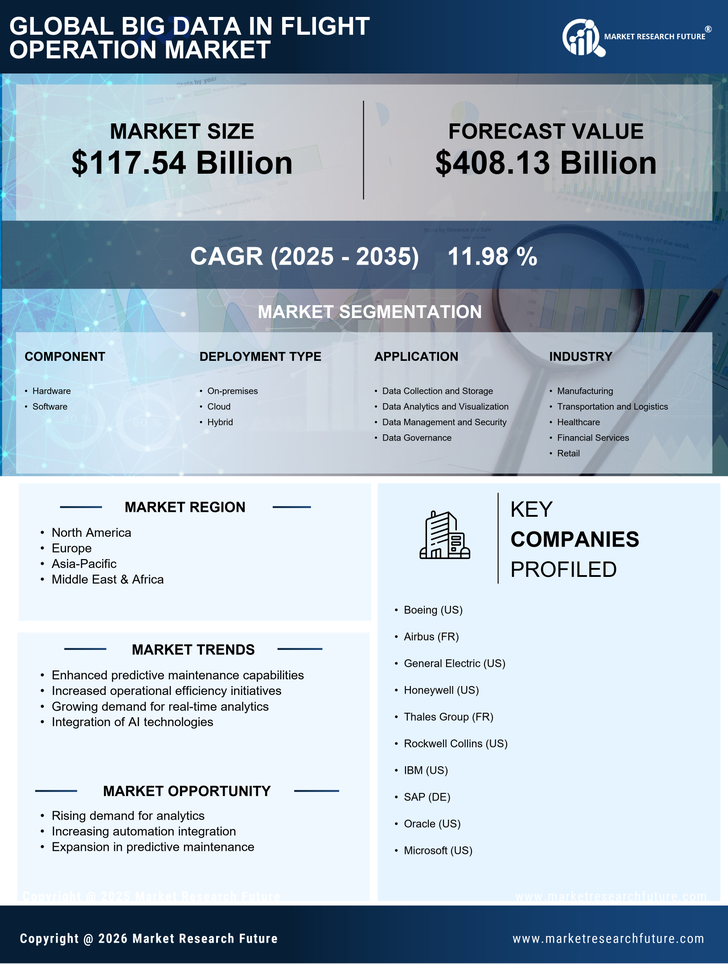

The growing focus on fuel efficiency is a critical driver in the Big Data In Flight Operation Market. Airlines are under increasing pressure to reduce operational costs and minimize their environmental impact. Big data analytics provides insights into fuel consumption patterns, enabling airlines to implement more efficient flight operations. By analyzing data related to flight paths, weather conditions, and aircraft performance, operators can optimize fuel usage, potentially leading to savings of up to 15% in fuel costs. This emphasis on fuel efficiency is likely to drive the adoption of big data solutions in the aviation sector, further enhancing the Big Data In Flight Operation Market.

Integration of IoT in Aviation Operations

The integration of Internet of Things (IoT) technology in aviation operations is emerging as a significant driver in the Big Data In Flight Operation Market. IoT devices facilitate the collection of real-time data from various aircraft systems, enabling airlines to monitor performance and operational metrics continuously. This influx of data allows for more informed decision-making and enhances operational efficiency. The IoT market in aviation is projected to grow substantially, with estimates suggesting a market size of USD 3 billion by 2027. This integration of IoT with big data analytics is expected to transform the operational landscape, driving growth in the Big Data In Flight Operation Market.

Advancements in Data Analytics Technologies

Technological advancements in data analytics are significantly influencing the Big Data In Flight Operation Market. Innovations such as machine learning, artificial intelligence, and real-time data processing are enabling airlines to analyze vast amounts of operational data efficiently. These technologies facilitate predictive analytics, which can forecast maintenance needs and optimize flight schedules. The integration of these advanced analytics tools is expected to enhance operational performance and reduce costs, with the market for aviation analytics projected to grow at a CAGR of 18% over the next five years. This evolution underscores the critical role of technology in shaping the Big Data In Flight Operation Market.

Regulatory Compliance and Safety Enhancements

Regulatory compliance and safety enhancements are pivotal drivers in the Big Data In Flight Operation Market. Airlines are mandated to adhere to stringent safety regulations, which necessitate the collection and analysis of operational data. Big data solutions enable operators to monitor compliance in real-time, ensuring adherence to safety protocols and reducing the risk of incidents. The market for safety analytics in aviation is anticipated to grow significantly, driven by the need for improved safety measures and risk management strategies. This focus on compliance and safety is likely to propel the demand for big data solutions within the Big Data In Flight Operation Market.

Increased Demand for Data-Driven Decision Making

The Big Data In Flight Operation Market is experiencing a surge in demand for data-driven decision-making processes. Airlines and operators are increasingly relying on data analytics to enhance operational efficiency and improve customer satisfaction. According to recent estimates, the market for big data analytics in aviation is projected to reach USD 2.5 billion by 2026, reflecting a compound annual growth rate of approximately 20%. This trend indicates a shift towards leveraging data insights for strategic planning, route optimization, and resource allocation, thereby driving the growth of the Big Data In Flight Operation Market.