Research Methodology on IT Operation Analytics Market

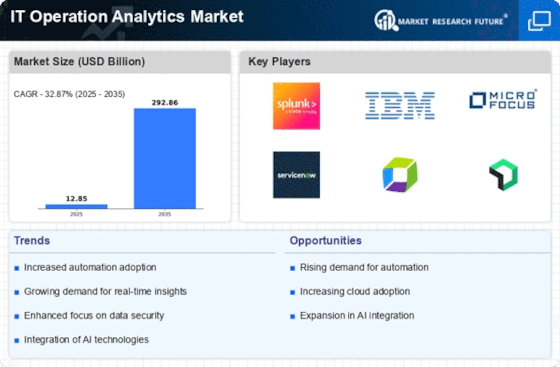

Introduction

This research study aims to explore and provide insight into the IT Operation Analytics market. In market research, the research methodology is the most important factor as it determines the course, accuracy and reliability of the results obtained from the market survey. The research methodology of this study will provide an overview of the entire research process. It includes the various activities that have been carried out in the research study. It will also provide information on the different methods used to carry out the research, the primary and secondary data collected, the models used to analyze the data and the justification for their use. The research methodology of the report has been divided into two parts, the first part deals with the primary research and the second part deals with the secondary research process.

Primary Research

Primary research is conducted to obtain direct information from the market. The primary research will provide an in-depth understanding of the current trends in the IT Operation Analytics market. Primary research methods used in this research study include interviews and questionnaires. The interview method was used to obtain feedback from senior executives from key players in the market. This includes industry experts and government officials. The results from the interviews provided insight into the current trends in the market and the future strategy for the players in the market. The questionnaire method was also used to obtain information from the customers of the IT Operation Analytics market. This method included a survey which was sent to a panel of individuals. The results from the survey helped in assessing the customer demand for IT Operation Analytics in the current market.

Secondary Research

Secondary research is conducted to obtain information from the public domain. The secondary research method used in this study included a detailed analysis of the market information published in various reports and internet sources. The sources used in this research include the company websites and financial documents, government publications, industry sector reports and other studies conducted by third parties. The secondary information was used to gain an understanding of the current activities in the IT Operation Analytics market, as well as trends and developments. The analysis of the secondary information helped in creating an overall picture of the market.

Data Analysis

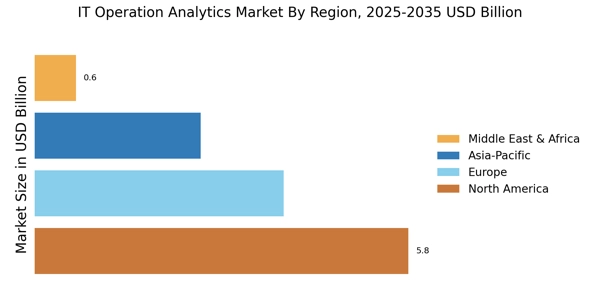

The data collected from the primary and secondary research methods were analyzed using statistical techniques such as correlation and regression analysis. The analysis of the data helped in understanding the trends in the IT Operation Analytics market. The results from the analysis were used to identify the key USPs of the IT Operation Analytics market, the competitive landscape and the future prospects in the market.

Conclusion

The research methodology presented in this report provides an overview of the entire research process. It includes the various methods used to collect and analyze data from primary and secondary research. The results from the research have been used to gain an understanding of the current trends in the IT Operation Analytics market and the future prospects for the market with forecast from 2023 to 2030.