Supportive Regulatory Frameworks

The Bio Butadiene Market is experiencing a favorable regulatory environment that encourages the adoption of bio-based products. Governments are implementing policies aimed at reducing greenhouse gas emissions and promoting renewable resources. For example, several countries have established mandates for biofuel usage, which indirectly supports the bio butadiene market. The European Union's Renewable Energy Directive is one such initiative that aims to increase the share of renewable energy in the market. This regulatory support not only incentivizes manufacturers to invest in bio butadiene production but also enhances consumer confidence in bio-based products. As regulations become more stringent regarding fossil fuel usage, the bio butadiene market is likely to benefit from increased demand.

Innovations in Production Technologies

Technological advancements in the production of bio butadiene are significantly influencing the Bio Butadiene Market. Innovations such as fermentation processes and catalytic conversion methods are enhancing the efficiency and cost-effectiveness of bio butadiene production. For instance, recent developments have shown that fermentation can yield bio butadiene with a purity level comparable to that of conventional methods. This could potentially lower production costs and increase market competitiveness. Moreover, the integration of biorefineries is expected to streamline the production process, making it more sustainable. As these technologies continue to evolve, they may lead to a more robust supply chain for bio butadiene, thereby expanding its application across various sectors.

Investment in Research and Development

Investment in research and development (R&D) is a significant driver for the Bio Butadiene Market. Companies are allocating substantial resources to innovate and improve bio butadiene production processes. This focus on R&D is expected to lead to breakthroughs that enhance yield, reduce costs, and improve the overall sustainability of bio butadiene. For instance, partnerships between academic institutions and industry players are fostering innovation in bioprocessing techniques. As R&D efforts intensify, the market is likely to see the introduction of new technologies that could revolutionize bio butadiene production. This ongoing investment in innovation is crucial for maintaining competitiveness in the evolving landscape of the bio-based chemicals market.

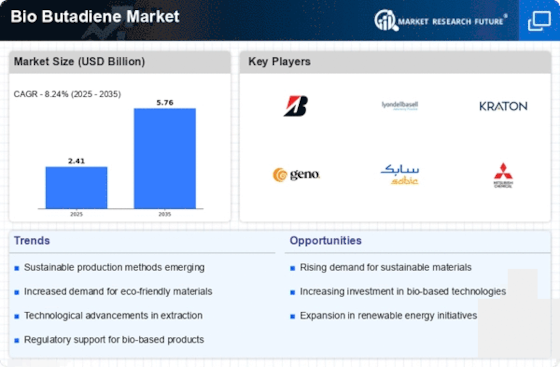

Rising Demand for Sustainable Materials

The increasing consumer preference for sustainable materials is a pivotal driver in the Bio Butadiene Market. As industries seek to reduce their carbon footprint, bio-based alternatives to traditional petrochemical products are gaining traction. This shift is evidenced by a projected growth rate of approximately 5% annually in the demand for bio-based chemicals, including bio butadiene. Companies are increasingly investing in sustainable practices, which is likely to enhance the market for bio butadiene as a renewable feedstock. Furthermore, the automotive and tire industries are particularly focused on sourcing sustainable materials, which could further bolster the demand for bio butadiene. This trend indicates a broader movement towards sustainability that is reshaping the Bio Butadiene Market.

Expanding Applications in Various Industries

The versatility of bio butadiene is a crucial driver for its market growth. The Bio Butadiene Market is witnessing an expansion in applications across various sectors, including automotive, plastics, and synthetic rubber. The automotive industry, in particular, is increasingly utilizing bio butadiene in the production of tires and other components, which is projected to grow at a rate of 4% annually. Additionally, the rise of eco-friendly products in consumer goods is further propelling the demand for bio butadiene. As industries continue to explore sustainable alternatives, the potential applications for bio butadiene are likely to broaden, thereby enhancing its market presence.

Leave a Comment