Market Share

Bioactive Ingredients Market Share Analysis

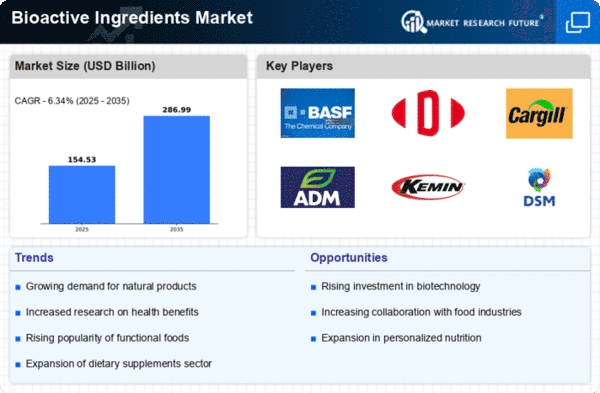

The Bioactive Ingredients market, a key player in the health and wellness sector, employs various market share positioning strategies to distinguish itself and thrive in a competitive landscape. Companies in this market strategically navigate product offerings, cost structures, and innovation to capture a significant portion of the market share.

One fundamental strategy in the Bioactive Ingredients market involves product differentiation. Companies strive to set their bioactive ingredients apart by emphasizing unique characteristics, such as specific health benefits, extraction methods, or applications. For instance, a company might highlight the antioxidant properties of its bioactive ingredients or their effectiveness in promoting cardiovascular health. This strategy not only attracts consumers looking for specialized health solutions but also establishes a distinct brand identity that stands out in a crowded market.

Cost leadership is another pivotal market share positioning strategy in the Bioactive Ingredients sector. Companies aim to become the cost-effective provider of high-quality bioactive ingredients by optimizing production processes, sourcing raw materials efficiently, and achieving economies of scale. This cost-conscious approach appeals to both consumers and businesses seeking health and wellness products that are not only effective but also budget-friendly. Cost leadership is particularly effective in markets where price sensitivity influences purchasing decisions.

Innovation plays a crucial role in the Bioactive Ingredients market, with companies investing in research and development to create novel formulations and applications. Staying ahead of scientific advancements allows companies to introduce bioactive ingredients with enhanced bioavailability, improved absorption rates, or novel delivery methods. This innovation-centric strategy not only helps companies secure a competitive edge but positions them as leaders in providing cutting-edge solutions for health-conscious consumers.

Strategic partnerships and collaborations are integral to market share positioning within the Bioactive Ingredients industry. Companies often forge alliances with research institutions, universities, or other players in the health and wellness ecosystem. Collaborative efforts can result in the development of new bioactive ingredients, the exploration of innovative production methods, or the expansion of product portfolios. Through strategic partnerships, companies can leverage shared expertise and resources to strengthen their market position.

Geographical expansion is a significant strategy in the Bioactive Ingredients market, allowing companies to tap into new markets with growing health awareness. This expansion may involve establishing a physical presence in different regions, forming partnerships with local distributors, or adapting products to meet specific regional preferences and regulations. Catering to diverse consumer needs and cultural nuances enables companies to broaden their market share across different geographical locations.

Customer-centric strategies are paramount in the Bioactive Ingredients market, where consumers prioritize health and wellness. Companies focus on understanding consumer preferences, offering personalized solutions, and providing transparent information about the health benefits of their products. Building trust through educational initiatives and transparent communication helps in fostering customer loyalty, ultimately solidifying a company's market share in the dynamic and evolving Bioactive Ingredients industry.

Leave a Comment