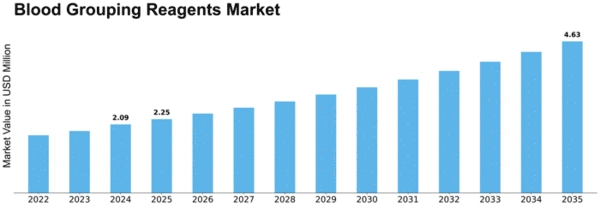

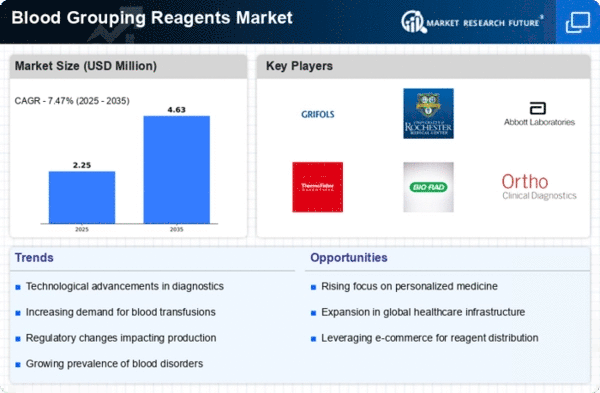

Blood Grouping Reagents Size

Blood Grouping Reagents Market Growth Projections and Opportunities

The global blood grouping reagents market is propelled by several key factors that influence the dynamics of animal healthcare and vaccination. One significant driver is the escalating emphasis on enhancing animal health, coupled with advancements in medicines and nutritional products tailored for animals. This evolving landscape, marked by a surge in pet adoptions, is anticipated to fuel the demand for therapeutics, diagnostics, and related products and services within the market. The increasing prevalence of animal diseases further augments this trajectory, creating a conducive environment for the growth of blood grouping reagents.

However, amidst this growth trajectory, concerns loom regarding the availability and circulation of counterfeit drugs. This apprehension casts a shadow over the market's expansion, potentially impeding its growth. The prevalence of counterfeit medications raises significant challenges, including compromised quality and efficacy, which might hinder the overall market growth.

Despite the promising surge in demand driven by animal healthcare advancements and increased pet adoption rates, the specter of counterfeit drugs poses a notable hurdle. Addressing these concerns becomes pivotal in sustaining the upward trajectory of the blood grouping reagents market. Efforts focused on mitigating the risks associated with counterfeit drugs are essential to ensure the continued growth and integrity of this vital segment within the broader spectrum of animal health and diagnostics.

The comprehensive study of the global blood grouping reagents market encompasses an in-depth analysis of various facets. This analysis spans a meticulous evaluation of market size and a detailed examination of manufacturers' products and service strategies. To ensure a comprehensive understanding, the market has been segmented across multiple parameters. These segments encompass product variations, different techniques employed, diverse test types, the spectrum of end users, and geographical regions.

This multifaceted segmentation strategy serves as a framework for a more granular and nuanced exploration of the market landscape. By delving into the distinct product categories, varied techniques employed, and the diverse array of tests conducted, the study aims to capture the intricate nuances shaping the blood grouping reagents market. Furthermore, an exploration of the end users' landscape provides insights into the varied needs and preferences across different sectors. Finally, a geographical breakdown offers a comprehensive view of regional dynamics and their influence on the market's evolution.

Through this meticulous segmentation, the study endeavors to offer a comprehensive and detailed analysis, shedding light on the diverse facets that define the global blood grouping reagents market. By scrutinizing each segment's unique characteristics, the aim is to provide a holistic perspective that aids in understanding the market's intricacies and its trajectory across various dimensions.

Leave a Comment