Market Growth Projections

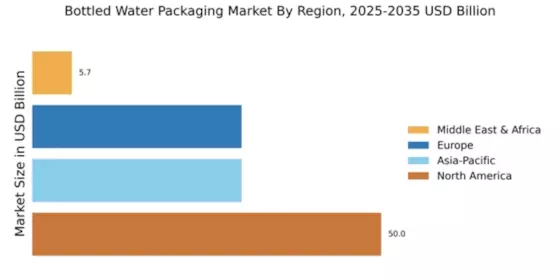

The Global Bottled Water Packaging Market Industry is poised for substantial growth, with projections indicating a market value of 115.7 USD Billion in 2024 and an anticipated increase to 246.0 USD Billion by 2035. This growth trajectory suggests a robust CAGR of 7.1% from 2025 to 2035. Factors contributing to this expansion include rising health consciousness, sustainability initiatives, and the demand for convenience. As consumers continue to prioritize hydration and seek convenient packaging solutions, the industry is likely to evolve to meet these needs. The increasing focus on innovative packaging technologies further supports this growth, positioning the market for a dynamic future.

Sustainability Initiatives

Sustainability initiatives play a crucial role in shaping the Global Bottled Water Packaging Market Industry. As environmental concerns gain prominence, consumers increasingly favor brands that adopt eco-friendly packaging solutions. The industry is witnessing a shift towards biodegradable materials and recyclable packaging, which not only reduce environmental impact but also resonate with eco-conscious consumers. Companies that prioritize sustainability are likely to capture a larger market share, as evidenced by the growing number of brands committing to reduce plastic waste. This trend is expected to contribute to the market's expansion, with projections indicating a market value of 246.0 USD Billion by 2035.

Convenience and Portability

Convenience and portability are paramount drivers in the Global Bottled Water Packaging Market Industry. The fast-paced lifestyle of modern consumers necessitates easy access to hydration solutions. Bottled water offers a practical and portable option for individuals on the go, whether during commutes, workouts, or travel. This demand for convenience is reflected in the increasing variety of packaging sizes and formats available in the market. Additionally, the rise of e-commerce platforms has further facilitated access to bottled water products, enhancing consumer convenience. As a result, the industry is poised for growth, with a projected CAGR of 7.1% from 2025 to 2035.

Rising Health Consciousness

The Global Bottled Water Packaging Market Industry experiences a surge in demand driven by increasing health consciousness among consumers. As individuals become more aware of the importance of hydration and the health benefits associated with drinking water, bottled water emerges as a convenient option. This trend is particularly evident in urban areas where busy lifestyles make bottled water a practical choice. The industry is projected to reach 115.7 USD Billion in 2024, reflecting the growing preference for healthier beverage alternatives. Furthermore, innovations in packaging that emphasize sustainability and convenience are likely to enhance consumer appeal, thereby propelling market growth.

Diverse Consumer Preferences

Diverse consumer preferences are shaping the Global Bottled Water Packaging Market Industry. With a growing variety of bottled water options available, including flavored, mineral, and sparkling varieties, consumers are increasingly seeking products that align with their tastes and lifestyles. This diversification caters to a broad demographic, from health enthusiasts to casual consumers. Companies that successfully adapt their packaging to reflect these preferences are likely to gain a competitive edge. Additionally, the rise of personalized packaging options, such as customizable labels, is enhancing consumer engagement. This trend is expected to contribute to the industry's growth, with projections indicating a market value of 246.0 USD Billion by 2035.

Innovative Packaging Technologies

Innovative packaging technologies significantly influence the Global Bottled Water Packaging Market Industry. Advances in packaging design and materials enhance product shelf life, reduce waste, and improve consumer experience. Technologies such as lightweight packaging and tamper-evident seals not only ensure product safety but also cater to consumer preferences for convenience. Furthermore, the integration of smart packaging solutions, which provide real-time information about product freshness and quality, is gaining traction. These innovations are likely to attract consumers seeking both quality and convenience, thereby driving market growth. The industry's evolution in packaging technology is expected to align with the projected market value of 115.7 USD Billion in 2024.