Driven by the country's increasing emphasis on digital transformation and modernization of financial services, the Brazilian Blockchain in Insurance Market is undergoing substantial trends. In an effort to promote the utilization of blockchain technology in a variety of sectors, including insurance, the Brazilian government has implemented regulations that are proactive.

A consequence of this has been a growing emphasis on the efficacy, security, and transparency of insurance processes, which are critical market drivers. Brazilian insurers are progressively employing blockchain technology to facilitate real-time data sharing among stakeholders, enhance underwriting accuracy, and streamline claims processing.

Moreover, the Brazilian Digital Governance Strategy is advocating for the integration of cutting-edge technologies, which presents an opportunity to develop new insurance products that are specifically designed to meet the unique requirements of businesses and consumers in the region.

The number of insurers and blockchain startups collaborating has significantly increased, resulting in the creation of platforms that improve client experiences and facilitate smart contracts. Companies are increasingly employing blockchain technology for identity verification and claims monitoring in order to enhance trust and mitigate fraud.

In recent years, the Brazilian insurance sector has created an environment that is encouraging innovation, particularly in the areas of microinsurance and peer-to-peer insurance, as a result of the integration of blockchain technology. These emerging trends are assisting in the resolution of coverage gaps in marginalized populations in Brazil by granting them access to insurance products that are uniquely designed for their circumstances.

Adherence to international standards and best practices will be essential for achieving sustained growth and a competitive edge in the swiftly changing market as it continues to evolve. Technology, regulation, and consumer demand have all come together to create a critical juncture in the Brazilian Blockchain in Insurance Market.

Brazil Blockchain in Insurance Market Drivers

Rising Demand for Transparency and Fraud Prevention

The need for enhanced transparency and effective fraud prevention mechanisms continues to rise in the Brazil Blockchain in Insurance Market Industry. A significant driver for this trend is the increasing frequency of insurance fraud cases, with reports indicating that losses due to fraud are costing the Brazilian insurance sector approximately 10% of its gross annual premiums.

This alarming statistic suggests that stakeholders in the insurance market see blockchain technology as a viable solution for verifying information and streamlining claims processes, thereby reducing fraud.

Major players in the Brazilian insurance market, such as Grupo Bradesco Seguros and Porto Seguro, are actively investing in blockchain solutions to enhance their operational efficiency.

In response to both industry needs and regulatory pushes, these organizations are exploring partnerships with technology firms to integrate blockchain into their existing workflows and ensure consumer trust, laying a strong foundation for growth in the Brazil Blockchain in Insurance Market.

Government Support for Digital Transformation

The Brazilian government has been taking proactive measures to encourage digital transformations across various sectors, including insurance. Initiatives like the National Strategy for Digital Transformation (ENDigital) aim to modernize the economy and promote innovative technologies such as blockchain. This governmental backing translates to an ecosystem where the Brazil Blockchain in Insurance Market Industry can thrive.

Moreover, government regulations that promote electronic signatures and documentation further propel the adoption of blockchain solutions, making processes more efficient and secure. As a result, large insurance companies, including MAPFRE and Allianz Brasil, are motivated to embrace blockchain technology as a means to comply with new regulations while improving customer experience.

Growing Investment in Technology Startups

In Brazil, a surge in venture capital investment into technology startups focused on blockchain applications in insurance is contributing significantly to the market's growth. In recent years, investments in fintech and insurtech companies have reached billions of Brazilian Reais, showcasing a broad recognition of the potential for transformative solutions within the sector.

Events such as the Insurtech Brazil Conference highlight Brazil's rapidly evolving insurtech landscape, attracting attention from both local and international investors.

For instance, established organizations like Dots and Juno, which are developing blockchain-based applications for insurance solutions, are gaining traction within this ecosystem. This increase in investments is expected to foster innovation within the Brazil Blockchain in Insurance Market Industry, enhancing its ability to address consumer needs effectively.

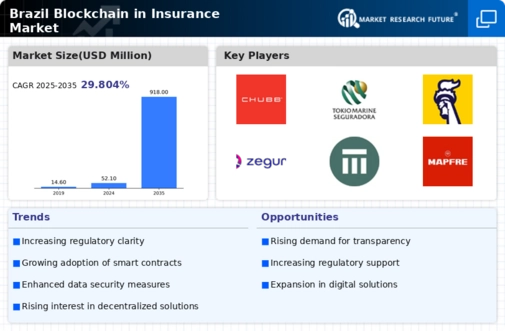

Brazil Blockchain in Insurance Market