Growth of Online Grocery Shopping

The rise of online grocery shopping in Brazil is significantly impacting the cold chain-monitoring market. As more consumers opt for home delivery services, the demand for efficient cold chain logistics has surged. Retailers are now required to maintain the integrity of perishable goods during transit, which necessitates advanced monitoring solutions. Recent statistics indicate that online grocery sales in Brazil are expected to reach $10 billion by 2027, highlighting the need for reliable cold chain systems. This trend is likely to drive investments in monitoring technologies, as businesses strive to meet consumer expectations for freshness and quality. Consequently, the cold chain-monitoring market is poised for growth, as it adapts to the evolving landscape of retail.

Rising Demand for Perishable Goods

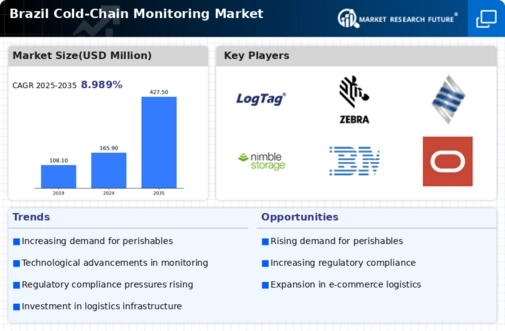

The increasing consumption of perishable goods in Brazil is a primary driver for the cold chain-monitoring market. As the population becomes more health-conscious, the demand for fresh produce, dairy, and meat products rises. This trend necessitates robust cold chain solutions to ensure product quality and safety. According to recent data, the perishable goods sector in Brazil is projected to grow at a CAGR of 6.5% over the next five years. Consequently, businesses are investing in advanced monitoring systems to maintain optimal temperature and humidity levels during transportation and storage. This heightened focus on quality assurance is likely to propel the cold chain-monitoring market, as stakeholders seek to minimize spoilage and enhance customer satisfaction.

Expansion of the Pharmaceutical Sector

The pharmaceutical sector in Brazil is experiencing rapid growth, which is a crucial driver for the cold chain-monitoring market. With the increasing production and distribution of temperature-sensitive medications and vaccines, the need for stringent monitoring solutions has become paramount. to ensure the efficacy of products. Regulatory bodies are imposing stricter guidelines on the transportation of pharmaceuticals, further emphasizing the importance of reliable monitoring systems. Consequently, stakeholders in the cold chain-monitoring market are likely to benefit from this expansion, as they provide essential solutions to meet compliance and quality assurance requirements.

Consumer Awareness and Safety Standards

Growing consumer awareness regarding food safety and quality is driving the cold chain-monitoring market in Brazil. As consumers become more informed about the risks associated with improper storage and transportation of food products, they demand higher safety standards from manufacturers and retailers. This shift in consumer behavior is prompting businesses to invest in advanced monitoring technologies to ensure compliance with safety regulations. The Brazilian government has implemented various food safety initiatives, which further necessitate the adoption of effective cold chain solutions. As a result, the cold chain-monitoring market is expected to grow, with an anticipated increase of 10% in market size over the next few years, driven by heightened consumer expectations.

Technological Integration in Supply Chains

The integration of advanced technologies into supply chains is significantly influencing the cold chain-monitoring market. In Brazil, companies are increasingly adopting IoT devices, blockchain, and AI to enhance visibility and traceability throughout the supply chain. These technologies facilitate real-time monitoring of temperature and humidity, ensuring compliance with safety standards. The Brazilian government has also been promoting digital transformation initiatives, which further encourages businesses to invest in smart cold chain solutions. As a result, the cold chain-monitoring market is expected to witness substantial growth, with an estimated increase of 15% in technology adoption rates over the next few years. This trend indicates a shift towards more efficient and transparent supply chain operations.