Rising Ethanol Production

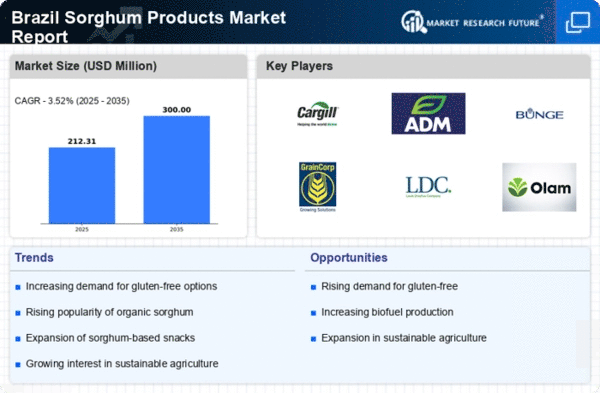

The increasing focus on renewable energy sources in Brazil is likely to drive the sorghum products market, particularly through the production of ethanol. Sorghum is recognized as a viable feedstock for biofuel production due to its high sugar content and adaptability to various climatic conditions. In 2025, Brazil's ethanol production is projected to reach around 30 billion liters, with sorghum potentially playing a significant role in this sector. The sorghum products market may benefit from this trend as demand for sorghum as a biofuel feedstock increases, leading to greater investment in sorghum cultivation and processing facilities.

Expanding Export Opportunities

Brazil's strategic position as a major agricultural exporter presents substantial opportunities for the sorghum products market. The country has been enhancing its export capabilities, particularly in the agricultural sector, which includes sorghum. In 2025, Brazil's sorghum exports are anticipated to increase by approximately 15%, driven by demand from international markets seeking high-quality grains. This expansion in export opportunities could stimulate domestic production and innovation within the sorghum products market, as producers aim to meet both local and global demands. The potential for increased revenue from exports may encourage further investment in sorghum processing and product development.

Increasing Health Consciousness

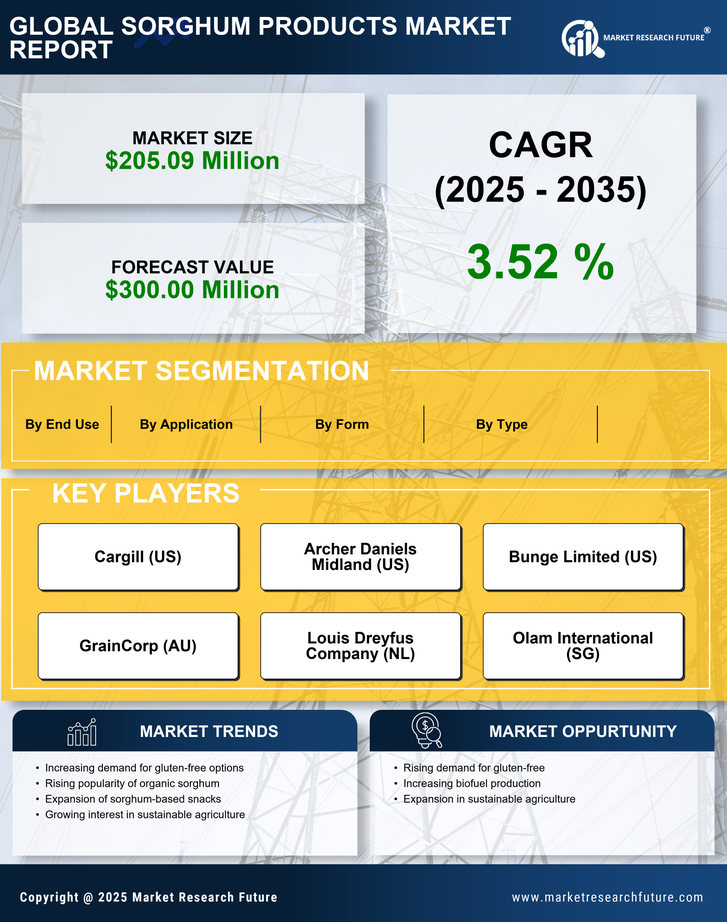

The rising awareness of health and nutrition among consumers in Brazil appears to be a significant driver for the sorghum products market. As individuals seek healthier dietary options, sorghum, known for its high fiber content and low glycemic index, is gaining traction. This trend is reflected in the growing demand for gluten-free alternatives, as many consumers are opting for products that support their health goals. In 2025, the market for gluten-free products in Brazil is projected to reach approximately $1.5 billion, with sorghum products likely to capture a notable share due to their nutritional benefits. The sorghum products market is thus positioned to benefit from this health-centric consumer behavior, potentially leading to increased product innovation and market expansion.

Consumer Preference for Sustainable Products

The growing consumer preference for sustainable and ethically sourced products is influencing the sorghum products market in Brazil. As consumers become more environmentally conscious, they are increasingly seeking products that align with their values. Sorghum, being a drought-resistant crop that requires fewer resources compared to other grains, is well-positioned to meet this demand. In 2025, it is estimated that the market for sustainable food products in Brazil will grow by 20%, with sorghum products likely to benefit from this trend. The sorghum products market may see an increase in product offerings that emphasize sustainability, appealing to a broader consumer base and enhancing market growth.

Government Support and Agricultural Policies

Brazil's government has been actively promoting the cultivation of sorghum through various agricultural policies and incentives. This support is crucial for the sorghum products market, as it encourages farmers to diversify their crops and invest in sorghum production. The government has implemented programs aimed at enhancing agricultural productivity and sustainability, which may lead to increased sorghum yields. In 2025, the area dedicated to sorghum cultivation in Brazil is expected to grow by approximately 10%, driven by favorable policies. This growth in production capacity could enhance the availability of sorghum products in the market, thereby meeting the rising consumer demand and contributing to the overall development of the sorghum products market.