Emerging Trends in Food Innovation

The sorghum products market is experiencing a wave of innovation as food manufacturers explore new applications for sorghum. This includes the development of ready-to-eat meals, snacks, and beverages that incorporate sorghum as a primary ingredient. The trend towards clean label products, which emphasize transparency and minimal processing, aligns well with sorghum's natural attributes. Market data suggests that the clean label food market is expanding rapidly, with consumers increasingly seeking products that are free from artificial additives. This presents a unique opportunity for sorghum-based products to thrive, as they can be marketed as wholesome and nutritious options. The ongoing innovation in food technology may further enhance the appeal of sorghum products, attracting a broader consumer base.

Support from Agricultural Policies

Government initiatives and agricultural policies aimed at promoting sustainable farming practices are likely to bolster the sorghum products market in North America. Programs that support crop diversification and provide financial incentives for farmers to grow sorghum can enhance its production and availability. The U.S. Department of Agriculture has recognized sorghum as a key crop, which may lead to increased funding and resources for research and development. This support could facilitate advancements in sorghum cultivation techniques and processing methods, ultimately benefiting the sorghum products market. As farmers adopt more sustainable practices, the overall supply chain for sorghum may become more efficient, further driving growth in this sector.

Increased Focus on Nutritional Value

As consumers become more health-conscious, there is a growing emphasis on the nutritional value of food products. Sorghum is recognized for its high fiber content, essential vitamins, and minerals, making it an attractive option for health-oriented consumers. The sorghum products market is responding to this trend by developing products that highlight these nutritional benefits. For instance, sorghum is rich in antioxidants and has a low glycemic index, appealing to those seeking healthier dietary choices. Market Research Future suggests that the demand for nutrient-dense foods is expected to increase, with consumers willing to pay a premium for products that offer health benefits. This trend is likely to enhance the visibility and acceptance of sorghum products in the North American market.

Growing Interest in Plant-Based Diets

The shift towards plant-based diets is gaining momentum in North America, driven by concerns over health, environmental sustainability, and animal welfare. Sorghum, as a versatile grain, fits well into this dietary trend, offering a sustainable and nutritious alternative to animal-based products. The sorghum products market is likely to benefit from this growing interest, as more consumers seek plant-based options for their meals. Data indicates that the plant-based food market is projected to reach $74 billion by 2027, suggesting a significant opportunity for sorghum-based products to capture market share. This trend may encourage food manufacturers to innovate and create new sorghum-based offerings that align with the preferences of health-conscious and environmentally aware consumers.

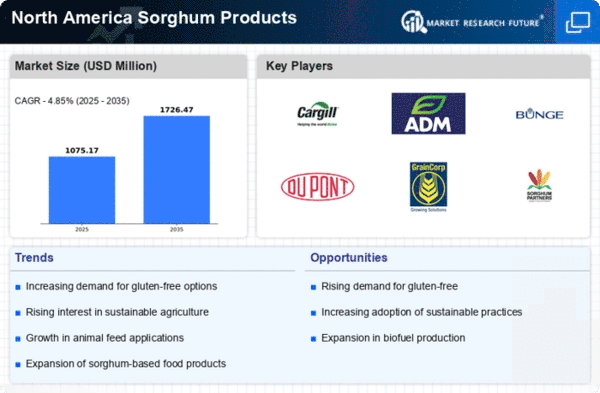

Rising Demand for Gluten-Free Products

The increasing prevalence of gluten intolerance and celiac disease among consumers in North America has led to a notable rise in demand for gluten-free products. Sorghum, being naturally gluten-free, is positioned favorably within this trend. The sorghum products market is witnessing a surge in product offerings that cater to this demographic, including gluten-free flours and snacks. Market data indicates that the gluten-free food market is projected to grow at a CAGR of approximately 9% through 2026, which bodes well for sorghum-based products. This shift in consumer preferences towards gluten-free options is likely to drive innovation and expansion within the sorghum products market, as manufacturers seek to capitalize on this growing segment.