Top Industry Leaders in the Building Thermal Insulation Market

The global building thermal insulation market upward trajectory is fueled by a confluence of factors, including rising energy costs, an increasing focus on sustainability, and stringent government regulations promoting energy-efficient buildings. Within this vibrant market, a complex and ever-evolving competitive landscape unfolds. Let's delve into the strategies, factors influencing market share, key industry news, and recent developments shaping the thermal insulation battleground.

Strategies Adopted by Market Players:

- Product Diversification: Leading companies are expanding their portfolios to cater to diverse needs. ROCKWOOL, for instance, focuses on fire-resistant rockwool while Owens Corning offers a variety of fiberglass and foam solutions. This differentiation allows companies to tap into specific market segments and gain a competitive edge.

- Sustainability Focus: Sustainability is becoming a key differentiator. Knauf Insulation, for example, emphasizes the use of recycled materials in its products. Companies are also investing in research and development to create eco-friendly alternatives like bio-based insulation materials.

- Technological Advancements: Innovation plays a crucial role in gaining an edge. Saint-Gobain, a global leader, invests heavily in R&D, leading to advancements like vacuum insulation panels (VIPs) offering exceptional thermal performance.

- Geographic Expansion: Established players like Knauf and Dow are expanding into emerging markets like Asia and Latin America, capitalizing on the growing demand for energy-efficient construction.

- Partnerships and Acquisitions: Strategic collaborations and acquisitions are common tactics. Huntsman Building Solutions' acquisition of Kingspan Insulation in 2022 exemplifies this trend, consolidating market share and expertise.

Factors Influencing Market Share:

- Product Quality and Performance: Superior thermal performance, durability, and ease of installation are critical factors influencing market share.

- Cost-Effectiveness: Balancing cost with performance is crucial. Companies like CertainTeed offer budget-friendly fiberglass options alongside premium products, catering to diverse customer segments.

- Brand Reputation and Recognition: Established brands like Rockwool and Owens Corning command trust and market share. Newer players can leverage innovative marketing strategies to compete.

- Government Regulations and Incentives: Stringent regulations like the EU's Energy Performance of Buildings Directive (EPBD) and government incentives for energy-efficient building materials stimulate demand for high-performance insulation.

- Regional Variations: Market dynamics vary across regions. Europe, for instance, leans towards mineral wool due to fire safety concerns, while North America sees strong demand for fiberglass and foam insulation.

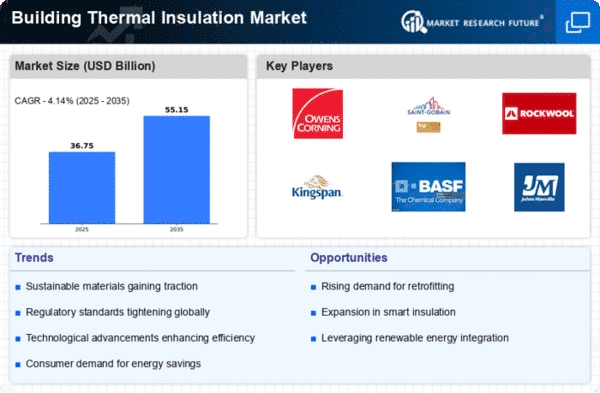

Key Companies in the Graphite market include

- Johns Manville Corporation

- Saint-Gobain SA

- BASF SE

- Kingspan Group

- Columbia Green Technologies

- Owens Corning

- Huntsman International LLC

- Rockwool International A/S

- Firestone Building Products Company, LLC

- Cabot Corporation

- Dow

- Covestro AG among others

Recent Developments

July 2023: ROCKWOOL announces the construction of a new production facility in Poland, aiming to increase its capacity to meet growing demand in Europe.

September 2023: Owens Corning unveils its new ComfortChoice™ Extreme Performance Attic Insulation, offering improved thermal resistance for hot and humid climates.

November 2023: The North American Insulation Manufacturers Association (NAIMA) hosts its annual conference, focusing on the latest advancements in insulation technologies and market trends.