Top Industry Leaders in the Busbar Systems Market

*Disclaimer: List of key companies in no particular order

Busbar Systems Latest Company Updates:

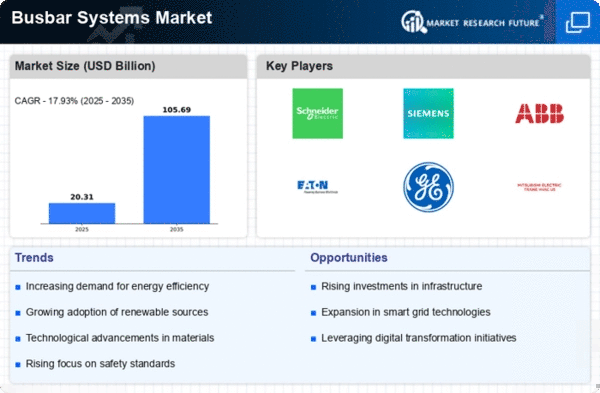

Competitive Landscape of the Busbar Systems Market: Powering Growth through Innovation

This surge is fueled by factors like rising industrial and infrastructure development, surging demand for energy efficiency, and growing awareness of busbars' benefits. However, navigating this dynamic landscape necessitates a keen understanding of the competitive scenario.

Key Players, Strategies, and Market Share Analysis:

- Global Giants: Leading the pack are established players like Schneider Electric, Siemens, ABB, and Eaton. These multinationals leverage their expansive distribution networks, robust R&D capabilities, and brand recognition to hold significant market share. Their strategies center around product diversification, customized solutions, and aggressive expansion into emerging economies.

- Regional Champions: Regional players like C&S Electric (India) and Tai Sin Electric Cables (China) cater to specific geographic needs and cost sensitivities. They compete on agility, price competitiveness, and strong local partnerships. Analyzing their growth trajectories in their respective regions can offer valuable insights into market dynamics.

- Niche Players: Smaller, innovative companies like NeoGear and BEShielding are carving niches by focusing on specialized applications or unique technologies. NeoGear's compact busbar solutions cater to space-constrained applications, while BEShielding's focus on electromagnetic interference (EMI) shielding caters to data centers and sensitive facilities. Studying their value propositions and target markets reveals emerging trends and future growth potential.

Factors for Market Share Analysis:

Market share analysis in the busbar systems market goes beyond mere revenue figures. Key factors to consider include:

- Product Mix: The range of busbar systems offered, including voltage ratings, conductor materials (copper versus aluminum), and insulation types (air versus encapsulated).

- End-Use Applications: Focus on dominant segments like data centers, industrial facilities, commercial buildings, and renewable energy installations.

- Geographic Presence: Strength in established markets like Europe and North America versus emerging markets like Asia Pacific and Latin America.

- Technological Advancements: Investment in smart busbar systems with communication capabilities and integration with Building Management Systems (BMS).

New and Emerging Trends:

- Digitalization: Smart busbars with real-time monitoring, fault detection, and predictive maintenance capabilities are gaining traction.

- Sustainability Focus: Eco-friendly materials, low-loss designs, and integration with renewable energy sources are becoming increasingly important differentiators.

- Modularization and Plug-and-Play Solutions: Simplifying installation and maintenance is crucial for wider adoption, particularly in retrofitting projects.

- Customization and Integration: Offering bespoke solutions tailored to specific project requirements is becoming a critical competitive advantage.

Overall Competitive Scenario:

The busbar systems market is characterized by intense competition, with players vying for market share through differentiation, innovation, and strategic partnerships. While global giants hold significant sway, regional and niche players are carving out valuable niches. Understanding the key factors influencing market share, identifying emerging trends, and analyzing player strategies are crucial for navigating this dynamic landscape and capitalizing on future growth opportunities.

In conclusion, the busbar systems market offers exciting prospects for players willing to adapt and innovate. By understanding the competitive landscape, key trends, and market share determinants, companies can position themselves for sustainable success in this electrifying market.

ABB Ltd. (Switzerland):

- Launched PowerBlox® Gen5 compact modular busbar system for data centers, offering increased efficiency and flexibility (October 2023, ABB press release).

R.J. Group (U.A.E.):

- Completed a major busbar project for a 1,200 MW power plant in Saudi Arabia (December 2023, R.J. Group website).

Busbar Services (South Africa):

- Developing innovative prefabricated busbar solutions for faster installations (August 2023, Busbar Services website).

C&S Electric Ltd. (India):

- Successfully commissioned a 400 kV GIS substation with busbar system for a wind farm project (October 2023, C&S Electric press release).

A.E EleKTrik A.S. (Turkey):

- Expanded its product portfolio with new low-voltage busbar systems for industrial applications (October 2023, A.E EleKTrik website).

Top listed global companies in the industry are:

ABB Ltd. (Switzerland)

R.J. Group (U.A.E.)

Busbar Services (South Africa)

C&S Electric Ltd. (India)

A.E EleKTrik A.S. (Turkey)

Eaton Corporation, P.L.C. (Republic of Ireland)

Entraco Power (India)

General Electric Company (U.S.)

Gersan EleKTrikAS. (Turkey)

Godrej & Boyce Manufacturing Company Ltd. (India)

Graziadio & C. S.P.A., (Italy)

IBAR (EMEA) Ltd. (Kendal, UK)

KGS Engineering Ltd., (Chennai, India)

Schneider Electric Co. (France)

Larsen & Toubro. (India)

(France)

Megabarre Group. (Italy)