Regulatory Compliance and Data Governance

Regulatory compliance and data governance are becoming increasingly critical drivers for the Business Intelligence Analytics Software Market. As organizations face stringent regulations regarding data privacy and security, the need for effective data management solutions is paramount. Business intelligence analytics software plays a vital role in ensuring compliance with regulations such as GDPR and CCPA by providing tools for data tracking, reporting, and auditing. The market for compliance-focused analytics solutions is projected to grow significantly, as businesses prioritize investments in software that can help them navigate complex regulatory landscapes. This focus on compliance not only mitigates risks but also enhances organizational credibility and trust with stakeholders. As a result, the demand for business intelligence analytics software that emphasizes regulatory compliance is expected to increase, further driving market growth.

Emergence of Advanced Analytics Techniques

The emergence of advanced analytics techniques is a transformative driver in the Business Intelligence Analytics Software Market. Techniques such as predictive analytics, machine learning, and artificial intelligence are reshaping how organizations analyze data and derive insights. These advanced methodologies enable businesses to forecast trends, identify potential risks, and optimize operations with greater accuracy. Recent market analyses indicate that the advanced analytics segment is anticipated to grow at a compound annual growth rate of around 15% over the next few years. This growth is indicative of the increasing recognition of the value that advanced analytics brings to decision-making processes. As organizations seek to harness the power of these techniques, the demand for business intelligence analytics software that incorporates advanced analytics capabilities is likely to rise, propelling the market forward.

Increased Adoption of Cloud-Based Solutions

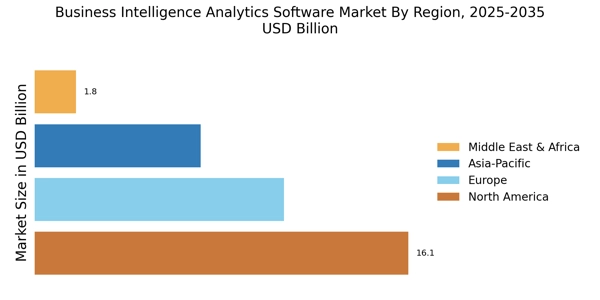

The shift towards cloud-based solutions is significantly influencing the Business Intelligence Analytics Software Market. Organizations are increasingly migrating their data and analytics operations to the cloud, driven by the need for scalability, flexibility, and cost-effectiveness. Cloud-based business intelligence solutions allow companies to access real-time data from anywhere, facilitating better collaboration and faster decision-making. Recent data indicates that the cloud segment of the business intelligence market is expected to account for over 50% of the total market share by 2026. This transition not only reduces the burden of maintaining on-premises infrastructure but also enhances data security and accessibility. As more businesses recognize these advantages, the demand for cloud-based business intelligence analytics software is anticipated to surge, further propelling market growth.

Rising Demand for Data-Driven Decision Making

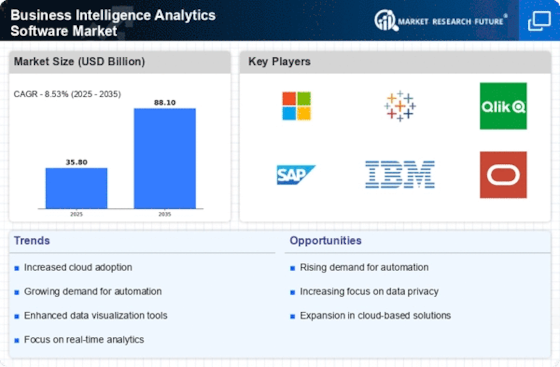

The increasing emphasis on data-driven decision making is a primary driver for the Business Intelligence Analytics Software Market. Organizations across various sectors are recognizing the value of leveraging data to enhance operational efficiency and strategic planning. According to recent estimates, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is fueled by the need for businesses to analyze vast amounts of data to gain insights that inform critical decisions. As companies strive to remain competitive, the adoption of business intelligence analytics software becomes essential, enabling them to transform raw data into actionable insights. Consequently, this trend is likely to continue, propelling the market forward as more organizations invest in advanced analytics capabilities.

Growing Importance of Data Visualization Tools

The rising importance of data visualization tools is a notable driver in the Business Intelligence Analytics Software Market. As organizations accumulate vast amounts of data, the ability to visualize this information effectively becomes crucial for understanding trends and patterns. Data visualization tools enable users to create intuitive dashboards and reports that simplify complex data sets, making insights more accessible to decision-makers. Recent studies suggest that the data visualization segment is expected to grow at a rate of 12% annually, reflecting the increasing reliance on visual analytics. This trend is particularly relevant as businesses seek to enhance their analytical capabilities and improve communication of insights across teams. Consequently, the demand for business intelligence analytics software that incorporates robust data visualization features is likely to rise, driving market expansion.