Integration of Advanced Technologies

The Business Analytics Software Market is witnessing a transformative phase characterized by the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enable organizations to analyze vast amounts of data with unprecedented speed and accuracy. The incorporation of predictive analytics and automated reporting tools is enhancing the capabilities of traditional business intelligence solutions. As a result, organizations are increasingly adopting these advanced analytics tools to derive actionable insights from their data. The market for AI-driven analytics solutions is expected to expand significantly, with estimates suggesting a growth rate of around 15% annually. This trend indicates a shift towards more sophisticated analytics capabilities within the Business Analytics Software Market.

Growing Importance of Real-Time Analytics

The Business Analytics Software Market is increasingly recognizing the importance of real-time analytics as organizations strive to make timely and informed decisions. The ability to analyze data in real-time allows businesses to respond swiftly to market changes and customer demands. This trend is particularly relevant in industries such as retail and e-commerce, where consumer preferences can shift rapidly. As a result, there is a growing demand for analytics solutions that provide real-time insights and dashboards. Market forecasts suggest that the real-time analytics segment will experience substantial growth, with an anticipated increase of around 18% in the coming years. This shift towards real-time capabilities is likely to reshape the landscape of the Business Analytics Software Market, driving innovation and competition among software providers.

Expansion of Cloud-Based Analytics Solutions

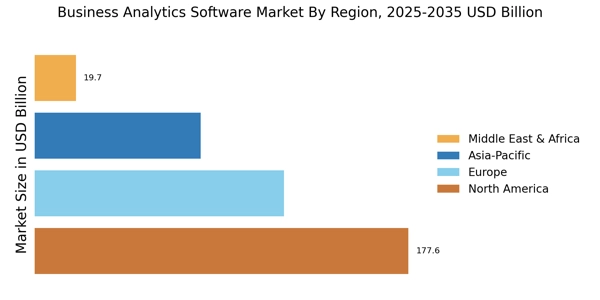

The Business Analytics Software Market is experiencing a significant shift towards cloud-based analytics solutions. Organizations are increasingly adopting cloud technologies to facilitate real-time data access and collaboration across teams. The flexibility and scalability offered by cloud-based platforms are appealing to businesses of all sizes, enabling them to deploy analytics tools without the need for extensive infrastructure investments. Recent market data indicates that the cloud analytics segment is projected to grow at a rate of approximately 20% over the next few years. This trend reflects a broader movement towards digital transformation, where businesses are leveraging cloud capabilities to enhance their analytical capabilities. As a result, the Business Analytics Software Market is likely to see a proliferation of cloud-based solutions tailored to meet evolving business needs.

Rising Demand for Data-Driven Decision Making

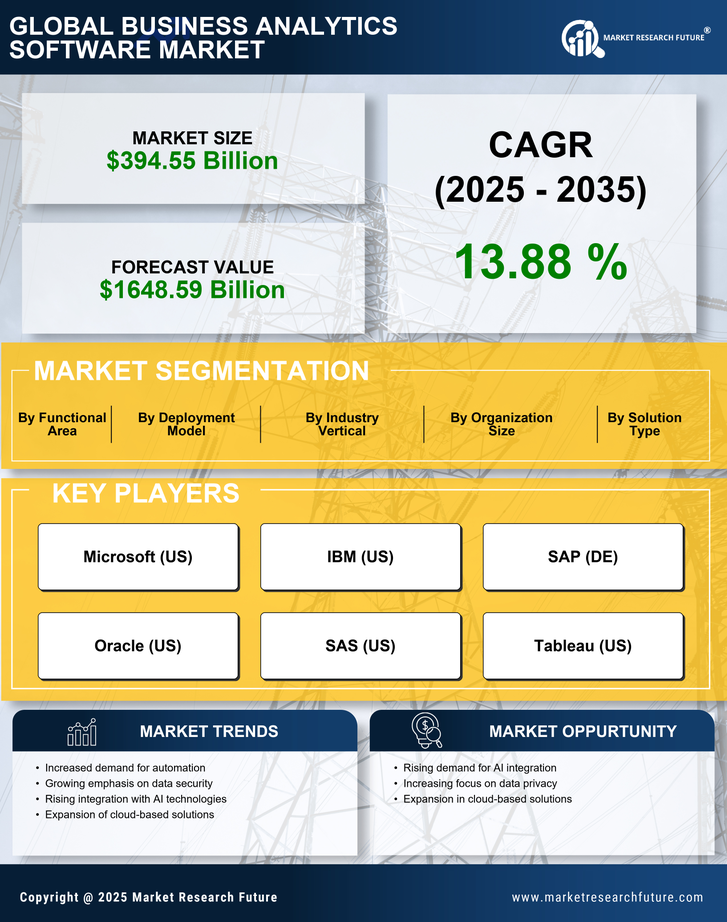

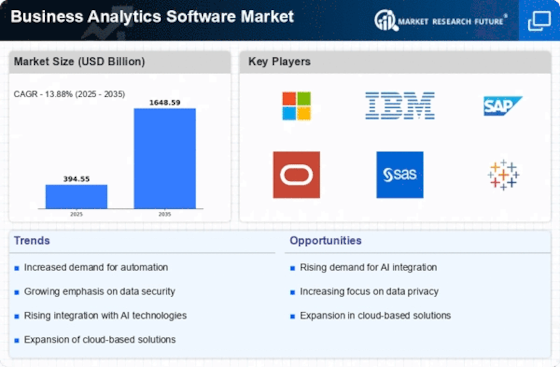

The Business Analytics Software Market is experiencing a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are leveraging analytics tools to gain insights that inform strategic choices, optimize operations, and enhance customer experiences. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This growth is fueled by the need for businesses to remain competitive in a rapidly evolving landscape, where data is becoming a critical asset. As organizations strive to harness the power of data, the Business Analytics Software Market is likely to see a proliferation of innovative solutions designed to meet diverse analytical needs.

Increased Focus on Data Security and Compliance

In the Business Analytics Software Market, there is a growing emphasis on data security and compliance as organizations navigate complex regulatory environments. With the rise of data breaches and privacy concerns, businesses are prioritizing solutions that ensure the protection of sensitive information. Analytics software providers are responding by incorporating robust security features and compliance tools into their offerings. This trend is particularly evident in sectors such as finance and healthcare, where regulatory requirements are stringent. As organizations seek to mitigate risks associated with data handling, the demand for secure analytics solutions is likely to drive growth in the Business Analytics Software Market. The market is expected to see an increase in investments aimed at enhancing data governance and security measures.