Global Competition and Collaboration

The competitive landscape of the quantum computing market is intensifying, with Canada positioning itself as a key player on the international stage. The collaboration between Canadian companies and global tech giants is fostering innovation and knowledge exchange. In 2025, several Canadian firms have entered partnerships with international organizations, enhancing their technological capabilities and market reach. This collaboration is crucial as it allows for shared resources and expertise, which can lead to accelerated advancements in quantum computing technologies. Furthermore, the competitive pressure from other nations is likely to drive Canadian companies to innovate more rapidly, ensuring they remain at the forefront of the quantum computing market. As a result, this dynamic environment may lead to increased investment and a more robust ecosystem for quantum technologies in Canada.

Increased Investment from Private Sector

The influx of private sector investment is significantly shaping the quantum computing market in Canada. Major technology companies and venture capitalists are recognizing the potential of quantum technologies, leading to substantial funding rounds. In 2025, investments in Canadian quantum startups have surged, with estimates suggesting a total of $300 million allocated to various projects. This financial backing is essential for research and development, enabling companies to innovate and bring new solutions to market. Furthermore, as private entities collaborate with academic institutions, the synergy fosters a robust ecosystem that accelerates advancements in quantum computing. The growing interest from the private sector not only enhances the technological landscape but also positions Canada as a competitive player in the global quantum computing arena.

Strengthening of Quantum Research Institutions

The establishment and strengthening of quantum research institutions in Canada play a crucial role in driving the quantum computing market. Institutions such as the Institute for Quantum Computing and the Quantum NanoFab are fostering innovation through research and collaboration. These centers are not only advancing theoretical research but also facilitating practical applications of quantum technologies. In 2025, funding for quantum research initiatives has increased by 40%, reflecting the government's commitment to enhancing Canada's position in the quantum landscape. This investment supports the development of skilled professionals and promotes partnerships between academia and industry. As research institutions continue to produce groundbreaking findings, they are likely to attract further investment and talent, thereby accelerating the growth of the quantum computing market.

Technological Advancements in Quantum Hardware

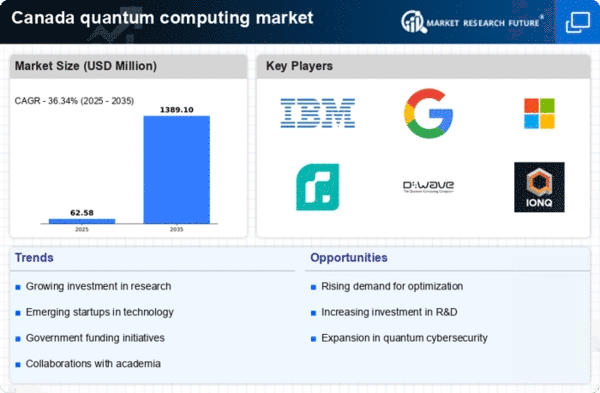

The rapid evolution of quantum hardware technologies is a pivotal driver for the quantum computing market in Canada. Innovations in qubit design, error correction, and quantum gate operations are enhancing computational capabilities. For instance, Canadian firms are at the forefront of developing superconducting qubits and trapped ion systems, which are crucial for building scalable quantum computers. The market is projected to reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 25%. This growth is indicative of the increasing demand for advanced computational power across various sectors, including finance, pharmaceuticals, and materials science. As hardware becomes more accessible and efficient, it is likely to attract further investment and research, thereby propelling the quantum computing market forward.

Rising Demand for Quantum Solutions in Industry

The increasing demand for quantum solutions across various industries is a significant driver for the quantum computing market in Canada. Sectors such as finance, healthcare, and logistics are exploring quantum computing to solve complex problems that classical computers struggle with. For example, financial institutions are leveraging quantum algorithms for risk analysis and portfolio optimization, which could lead to more efficient trading strategies. The healthcare sector is also investigating quantum computing for drug discovery and personalized medicine, potentially reducing development times and costs. As industries recognize the transformative potential of quantum technologies, the market is expected to expand, with estimates indicating a growth rate of 30% annually in the coming years. This trend underscores the necessity for businesses to adapt and integrate quantum solutions into their operations.