Research Methodology on Enterprise Quantum Computing Market

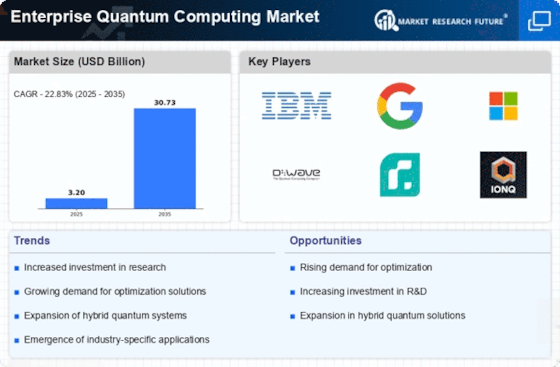

This research report on the Global Enterprise Quantum Computing Market is an in-depth analysis of the current market and an estimation of the upcoming market trends. Market Research Future conducted an extensive study of the enterprise quantum computing market through primary and secondary research. The report mainly focuses on the current and future trends related to the Enterprise Quantum Computing market. The global enterprise quantum computing market is estimated to grow at a healthy compounded annual growth rate (CAGR) during the forecast period 2023-2030.

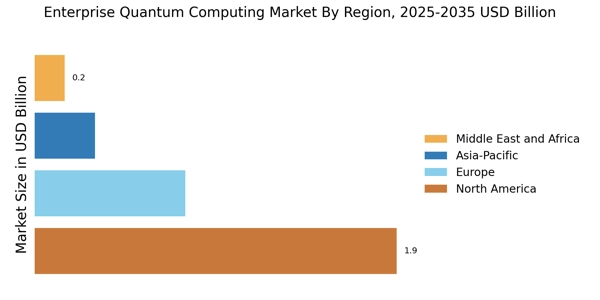

To provide a comprehensive view of the market trends and their contributions towards the overall enterprise quantum computing market, we have included different segments that provide accurate insights into the enterprise quantum computing market dynamics. The segments covered in this report include type, application, end-user, and region.

In addition to the market segmentation, the report provides an overview of the regulatory framework governing the enterprise quantum computing market. The report also offers a detailed analysis of the corporate strategy, company profile and product portfolio of each company profiled in the report. Moreover, the report provides a detailed financial analysis of the major players in the market.

The enterprise quantum computing market report is based on data obtained from primary and secondary research. The primary research includes interviews with industry experts and stakeholders. The interviews were conducted using a questionnaire. The survey questionnaire had questions related to the market size and growth potential. The surveys also provided information related to key players in the market. The primary research also included market intelligence from various industry publications and trade reports.

The secondary research included press releases, annual reports, white papers, and company websites. The secondary research provided information regarding the market landscape and competitive landscape. The research methodologies used in this report cover Porter’s Five Forces Analysis, Technological & Product Benchmarking, Market Analysis through Penning Analysis, And Competitor Profiling.

All the data obtained from the primary and secondary sources was then gathered and validated. After the validation process, the data was collected and analyzed using sophisticated techniques such as SPSS, Excel, and MATLAB. This validated data is categorized into regional and worldwide market segments, type, application, end-user, and industry verticals.

The market sizing process includes the assessment of industry sources as well as the overall data obtained from secondary and primary research. The report then provided a quantitative and qualitative review of the enterprise quantum computing market based on the global market.

Finally, the report concluded with a detailed market summary and market forecast for the period 2023-2030.