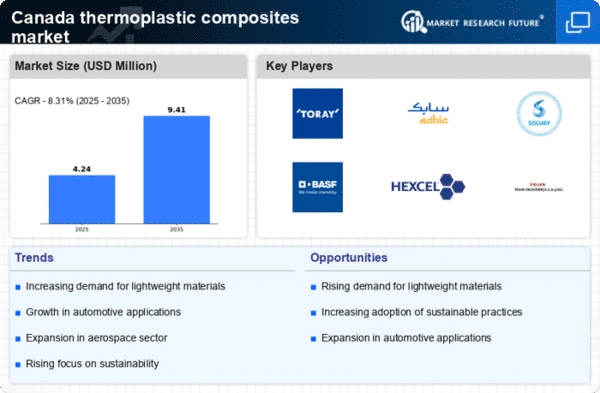

The thermoplastic composites market in Canada is characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Key players such as Toray Industries (Japan), SABIC (Saudi Arabia), and Solvay (Belgium) are actively shaping the market through their distinct operational focuses. Toray Industries (Japan) emphasizes advanced material development, particularly in aerospace applications, while SABIC (Saudi Arabia) is leveraging its extensive petrochemical expertise to enhance the performance characteristics of its composites. Solvay (Belgium) is focusing on sustainability, aiming to reduce the environmental impact of its products, which aligns with the growing demand for eco-friendly materials. Collectively, these strategies foster a competitive environment that prioritizes technological advancement and market responsiveness.In terms of business tactics, companies are increasingly localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several key players exerting influence over specific segments. This fragmentation allows for niche players to thrive, while larger corporations consolidate their positions through strategic acquisitions and partnerships. The collective influence of these companies shapes a competitive framework that encourages innovation and responsiveness to market demands.

In October Toray Industries (Japan) announced a collaboration with a leading aerospace manufacturer to develop next-generation thermoplastic composites aimed at reducing weight and enhancing fuel efficiency in aircraft. This strategic move underscores Toray's commitment to innovation and positions it favorably within the aerospace sector, where performance and sustainability are paramount. The partnership is expected to yield significant advancements in material properties, potentially setting new industry standards.

In September SABIC (Saudi Arabia) launched a new line of thermoplastic composites designed specifically for automotive applications, focusing on lightweighting and improved recyclability. This initiative reflects SABIC's strategic pivot towards sustainability, addressing the automotive industry's increasing demand for eco-friendly materials. The introduction of these composites is likely to enhance SABIC's market share in the automotive sector, aligning with global trends towards greener manufacturing practices.

In August Solvay (Belgium) expanded its production capacity for thermoplastic composites in Canada, investing €50 million in a new facility. This expansion is indicative of Solvay's strategic focus on meeting the rising demand for high-performance materials in various industries, including aerospace and automotive. The increased capacity is expected to bolster Solvay's competitive edge, allowing for greater responsiveness to customer needs and market fluctuations.

As of November current competitive trends in the thermoplastic composites market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly vital, as companies seek to enhance their innovation capabilities and market reach. The shift from price-based competition to a focus on technological differentiation and supply chain reliability is evident. Moving forward, competitive differentiation will likely evolve through continuous innovation and the development of sustainable solutions, positioning companies to better meet the demands of an increasingly environmentally conscious market.