Market Share

Canned Beverages Market Share Analysis

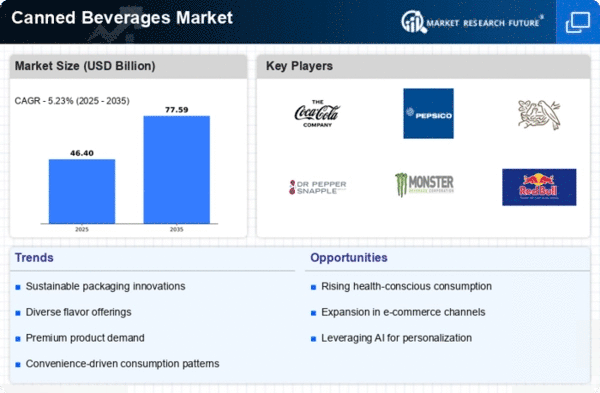

In this powerful scene, organizations inside the Canned Beverages market are utilizing assorted market share situating systems to separate themselves and gain an upper hand. Expected to display significant development during the conjecture time frame, the Canned Beverages Market is portrayed by the handling and bundling of beverages in impenetrable jars. These lightweight and recyclable drink jars stand out inferable from the heightening worldwide interest for canned beverages. The market is ready for extension as it profits by the complex benefits presented by these inventive bundling arrangements.

Canned beverages present a bunch of advantages, including fast chilling, offering an unrivaled metal material for printing, and defending the flavor and uprightness of the beverages. The accommodation and productivity of canned beverages, combined with their eco-accommodating nature, add to their flooding prevalence in the worldwide market. The lightweight plan upgrades compactness, pursuing canned beverages a favored decision for customers in a hurry.

As purchaser inclinations line up with the comfort and maintainability related with canned beverages, the market is set to encounter a prominent Build Yearly Development Rate (CAGR). The flexibility of canned beverages to contemporary ways of life, combined with their positive ecological effect, positions them as a critical player in the developing scene of the refreshment business. The determined development highlights a shift towards inventive and feasible bundling arrangements, mirroring the unique transaction between buyer interest and market patterns. Separation through item development is a critical procedure in the Canned Beverages market. Organizations are continually presenting new and exceptional drink details, traversing different flavors, utilitarian fixings, and low-calorie choices. By offering a different scope of decisions, they expect to catch the consideration of customers looking for novel and reviving encounters in helpful, convenient bundling.

Cost authority is one more conspicuous market share situating system saw in the Canned Beverages market. A few organizations center around streamlining creation processes, proficient inventory network the executives, and economies of scale to offer seriously evaluated canned beverages. This approach focuses on a wide buyer base, especially cost touchy people searching for reasonable and helpful drink choices.

Wellbeing and health situating is progressively predominant in the Canned Beverages market. Organizations stress the nourishing advantages of their items, frequently consolidating normal fixings, decreased sugar content, and utilitarian added substances. By adjusting their contributions to the developing pattern of wellbeing cognizant commercialization, these organizations expect to catch a portion of the market looking for better choices in compact, canned designs.

Market division assumes a vital part in the Canned Beverages market's serious scene. Organizations make particular items custom fitted for explicit socioeconomics or events, for example, caffeinated drinks for wellness fans, regular juices for wellbeing cognizant buyers, or non-alcoholic canned mixed drinks for get-togethers. This designated approach permits organizations to address different customer needs and inclinations actually.

Geographic development is an essential move in the Canned Beverages market, as organizations try to take advantage of new locales with rising interest for helpful, prepared to-drink choices. Extending appropriation organizations and entering developing markets empower organizations to expand their client reach and gain market share. This system lines up with the worldwide pattern of urbanization and expanding customer dependence on advantageous bundled beverages.

Coordinated efforts and associations are turning out to be more normal in the Canned Beverages market. Lining up with famous powerhouses, big names, or occasions assists organizations with improving their item perceivability and believability. Cooperative marketing endeavors, like co-marked advancements or restricted release joint efforts, add to building brand mindfulness and drawing in customers searching for in vogue and embraced drink choices.

Manageability is arising as an essential market share situating technique in the Canned Beverages market. Organizations are progressively integrating eco-accommodating bundling materials, advancing reusing drives, and taking on manageable obtaining rehearses. This procedure resounds with naturally cognizant purchasers who focus on items that line up with their qualities, adding to mark a positive market situating.

Leave a Comment