Canned Beverages Size

Canned Beverages Market Growth Projections and Opportunities

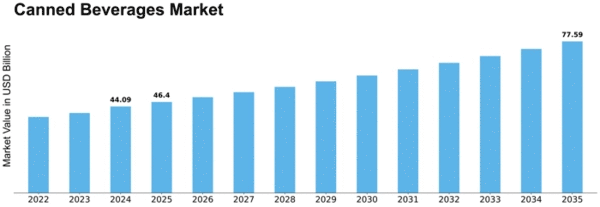

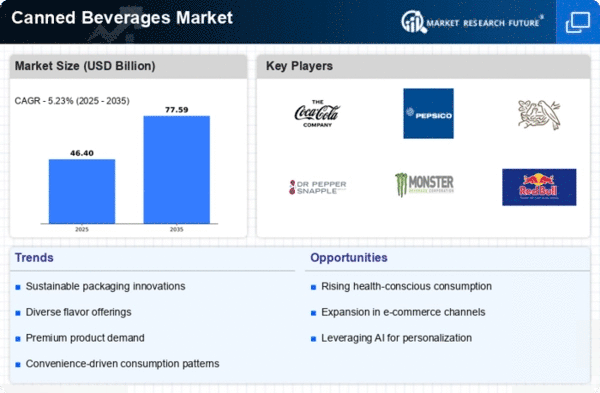

Many factors affect the canned beverage market's growth and development. Buyer comfort is crucial. A flexible and easy-to-use bundling arrangement for canned beverages matches today's fast-paced lifestyles. The comfort aspect and ability to store and carry liquids securely have made canned drinks popular across socioeconomic groups. An anticipated 5.4% Build Yearly Development Rate (CAGR) would drive the Canned Beverages market to USD 53.28 billion by 2030. This supposition shows the company's adaptability to changing client preferences and market factors.

Canned beverage popularity and constant CAGR show vertical support. Canned bundling's convenience, portability, and extended usage duration fit the modern lifestyle of busy customers. Advances in drink plans, bundling technologies, and a growing consumer preference for diverse and useful refreshment options further drive industry growth.

Maintainability considerations affect the Canned Beverages industry. As consumers grow more aware, the packaging industry, notably canned goods, is under scrutiny. Eco-friendly packaging and fair production and distribution may win over environmentally conscious consumers and influence their market choices.

Canned Beverages market growth depends on mechanical advances in canning cycles and materials. Canned beverages are more appealing due to can design, new materials, and mending developments. Mechanical advances have also expanded the range of beverages that may be packaged in jars, including carbonated drinks, squeezes, and ready-to-drink teas and espressos.

The canned beverage business is influenced by unofficial regulations and naming requirements. Compliance with food handling requirements, drive reuse, and accurate ingredient and dietary data naming are essential for customer trust. Administrative regulations ensure canned beverage quality and safety, boosting market perception.

In shaping the canned beverage business, competition and marketing are crucial. Market diversity is increased by refreshment brands and newcomers. As shoppers hunt for trusted brands that offer value, flavor, and variety in canned beverages, compelling branding, marketing, and communication tactics influence their choices. Brand loyalty and recognition boost market share.

Social and beverage preferences affect the canned beverage business. As tastes change, canned drinks adapt to local and societal trends. Neighborhood and socially energized drinks in jars reflect market preferences and social intricacies.

Customer preferences and health trends affect the canned beverage business. Low-sugar, regular, and utilitarian drinks are becoming more popular as health is prioritized. These health-conscious preferences will likely drive demand for canned beverages such sparkling water, ordinary juices, and helpful beverages.

Leave a Comment