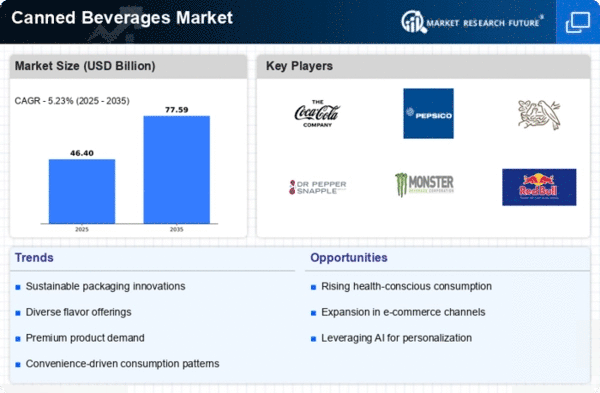

Market Growth Projections

The Global Canned Beverages Industry is poised for substantial growth, with projections indicating a market value of 27.9 USD Billion in 2024 and an anticipated increase to 62.4 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 7.61% from 2025 to 2035. Factors contributing to this expansion include rising consumer demand for convenience, health-conscious choices, and innovative product offerings. As the market evolves, it is essential to monitor these trends and their implications for future growth.

Health and Wellness Trends

The Global Canned Beverages Industry is witnessing a shift towards health-conscious choices among consumers. An increasing awareness of health and wellness has led to a demand for beverages that offer functional benefits, such as low-calorie options, natural ingredients, and added vitamins. This trend is particularly evident in the rise of canned beverages that promote hydration and energy without excessive sugar content. Brands are responding by innovating their product lines to include healthier alternatives, which could potentially enhance market growth. As the market adapts to these health trends, it is anticipated that the Global Canned Beverages Industry will continue to evolve and thrive.

Rising Consumer Demand for Convenience

The Global Canned Beverages Industry experiences a notable surge in consumer demand for convenience-oriented products. As lifestyles become increasingly fast-paced, consumers gravitate towards ready-to-drink options that require minimal preparation. Canned beverages, including soft drinks, juices, and energy drinks, cater to this need effectively. The convenience factor is particularly appealing to younger demographics, who often prioritize on-the-go consumption. This trend is expected to bolster the market, contributing to a projected market value of 27.9 USD Billion in 2024. As convenience continues to drive purchasing decisions, the Global Canned Beverages Industry is likely to expand significantly.

Technological Advancements in Production

Technological advancements in production processes are significantly influencing the Global Canned Beverages Industry. Innovations such as automated filling and sealing technologies enhance efficiency and reduce production costs. Moreover, advancements in preservation techniques allow for longer shelf life without compromising taste or quality. These improvements not only streamline operations but also enable manufacturers to respond swiftly to changing consumer preferences. As technology continues to evolve, it is likely that the Global Canned Beverages Industry will benefit from increased productivity and enhanced product offerings, further driving market growth.

Sustainability and Eco-Friendly Packaging

Sustainability has emerged as a pivotal driver in the Global Canned Beverages Industry. Consumers are increasingly concerned about environmental impact, prompting brands to adopt eco-friendly packaging solutions. Canned beverages, being recyclable and often made from sustainable materials, align well with these consumer preferences. Companies are investing in sustainable practices, such as reducing carbon footprints and utilizing renewable resources, to appeal to environmentally conscious consumers. This commitment to sustainability not only enhances brand loyalty but also positions the Global Canned Beverages Industry favorably in a competitive landscape. As sustainability becomes integral to consumer choices, the market is likely to benefit from this trend.

Innovative Flavor Profiles and Product Diversification

Innovation in flavor profiles and product diversification plays a crucial role in the Global Canned Beverages Industry. Manufacturers are increasingly experimenting with unique and exotic flavors to attract a broader consumer base. This trend is particularly pronounced in the craft beverage segment, where small producers are gaining traction by offering distinctive taste experiences. Additionally, the introduction of limited-edition flavors and seasonal offerings keeps the market dynamic and engaging for consumers. As brands continue to innovate, the Global Canned Beverages Industry is expected to see sustained growth, with projections indicating a market value of 62.4 USD Billion by 2035.