Market Trends

Key Emerging Trends in the Carbon-Neutral Fuels Market

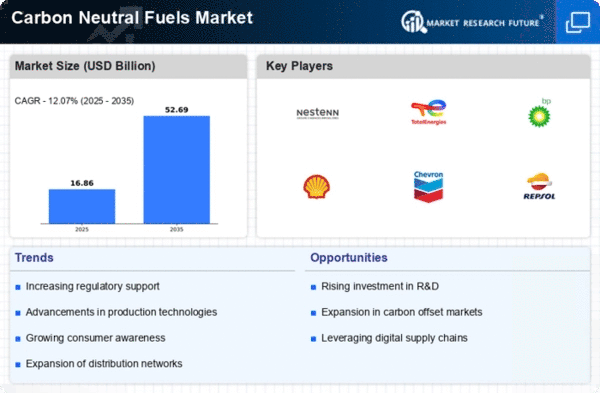

The Carbon-Neutral Fuels Market is witnessing a significant shift as global attention intensifies on sustainable and environmentally friendly energy solutions. With increasing concerns about climate change and the detrimental effects of traditional fossil fuels, there has been a notable surge in demand for carbon-neutral fuels. These fuels, also known as renewable or green fuels, are produced through processes that either capture and offset carbon emissions or utilize feedstocks that do not contribute to a net increase in greenhouse gases. One prominent market trend is the growing investment in research and development to enhance the production efficiency and scalability of carbon-neutral fuels.

Various stakeholders, including governments, private companies, and research institutions, are actively investing in technologies such as carbon capture and utilization, biomass conversion, and synthetic fuel production. These efforts aim to make carbon-neutral fuels more economically viable and accessible on a larger scale, ultimately fostering their widespread adoption. The transportation sector is emerging as a key driver for the carbon-neutral fuels market. Governments worldwide are implementing stringent regulations to reduce carbon emissions from vehicles, pushing automotive manufacturers to explore alternative fuel options. Carbon-neutral fuels, such as biofuels and synthetic fuels, offer a promising solution for reducing the carbon footprint of transportation. As a result, there is a growing trend of collaborations and partnerships between fuel producers and automotive companies to integrate carbon-neutral fuels into existing infrastructure and vehicle fleets. Consumer awareness and preferences are also influencing the market trends of carbon-neutral fuels. With an increasing emphasis on sustainability, consumers are becoming more conscious of the environmental impact of their choices, including the fuels they use. This shift in consumer behavior is prompting businesses to adopt sustainable practices, leading to a rise in the demand for carbon-neutral fuels. As a response, fuel retailers are incorporating renewable options into their product portfolios, catering to a growing market of eco-conscious consumers. Furthermore, government policies and incentives are playing a crucial role in shaping the market landscape of carbon-neutral fuels. Many countries are implementing regulatory frameworks and financial incentives to encourage the production and consumption of renewable fuels. These policies aim to create a favorable environment for businesses to invest in carbon-neutral technologies and promote the transition towards a more sustainable energy landscape. Governments are also exploring carbon pricing mechanisms to encourage industries to reduce their carbon emissions, indirectly driving the demand for carbon-neutral fuels.

Despite the positive trends, challenges remain in the carbon-neutral fuels market. The cost of production, limited infrastructure, and the need for significant technological advancements are obstacles that industry players must overcome. However, ongoing advancements in technology, coupled with increasing global awareness and regulatory support, are expected to address these challenges over time. In conclusion, the market trends of the Carbon-Neutral Fuels Market reflect a promising trajectory towards a more sustainable and environmentally friendly energy future. As investments in research and development continue to drive technological innovations, and governments and consumers alike prioritize sustainable choices, carbon-neutral fuels are poised to play a pivotal role in the global transition towards a low-carbon economy.

Leave a Comment