Research Methodology on Cargo Shipping Market

1. Introduction:

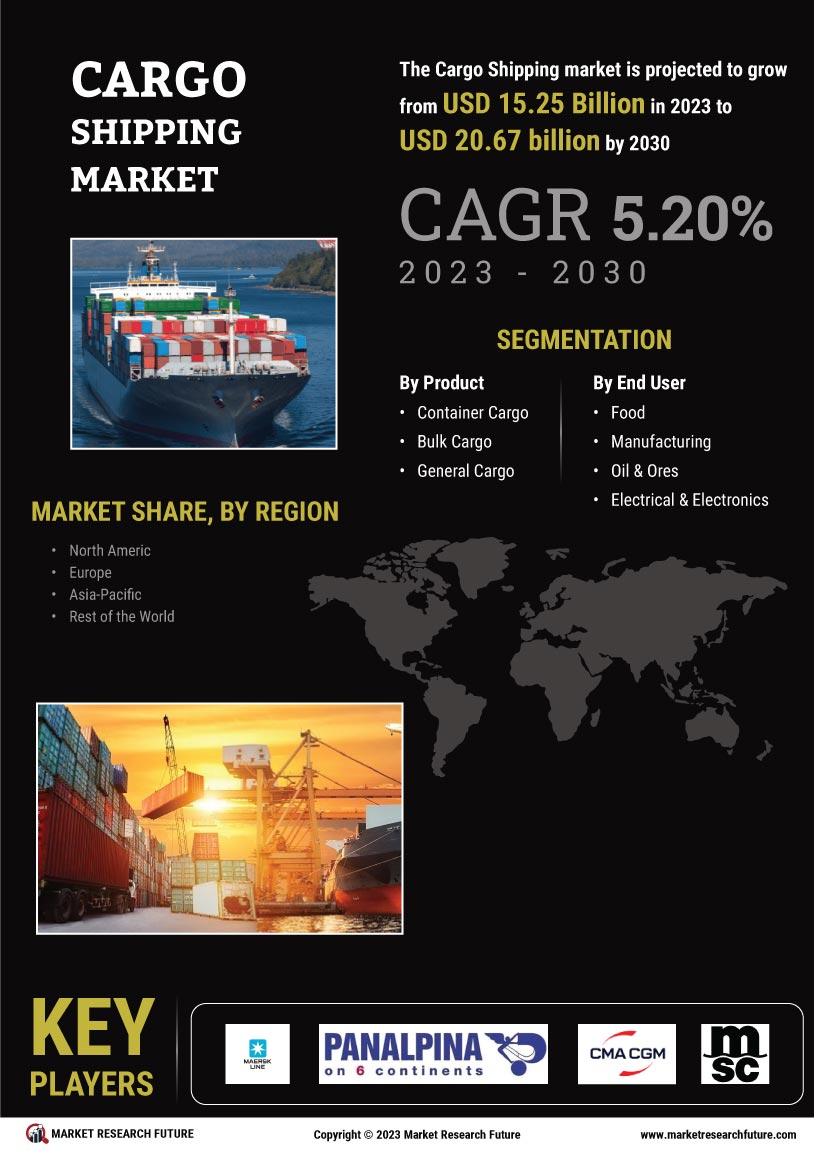

The cargo shipping market is expected to witness steady growth over the forecast period 2023 to 2030 with increasing investments from major key players in the market. The accelerated trend towards digitization and rising demand for efficient transportation management systems are the major factors driving the growth of the cargo shipping market. The major factor elevating the market growth is the increased demand for cost-effective transportation solutions for transportation, enhancing customer experience, and improved efficiency in the supply chain. According to a report published by Market Research Future (MRFR), the global cargo shipping market is anticipated to register a strong CAGR during the forecast period from 2023 to 2030.

2. Research Design, Objectives and Scope:

The research design adopted for this research study was a mix of both primary and secondary sources of data. The primary research objective for the study was to gain a comprehensive understanding of the cargo shipping market including qualitative insights on drivers, trends, challenges, and market size. For gathering primary data, in-depth interviews were conducted with experts in the field of cargo shipping. Secondary research sources included white papers, company websites, annual reports, paid database services, and industry association journals. The secondary research objective was to obtain an in-depth understanding of the cargo shipping market dynamics and to validate the primary research findings. This research study covered both the demand side and the supply side as well as geographic analysis.

3. Research Approach:

The following research approach was used to complete the research study:

• Bottom-up Approach – This approach begins with individual components or sub-elements and gradually builds upon them to ultimately come to a conclusion. This approach was used to understand the entire cargo shipping market, its various components, their relevance in the global market, and their impact on the entire market.

• Top-down Approach – This approach provides an understanding of the entire market based on its various components, interconnectedness, and their impact on the overall market structure. A top-down approach was followed to understand the drivers and challenges in the cargo shipping market as well as its various end-use segments.

• Factor Analysis – This analysis was done to identify and analyze the key factors driving the cargo shipping market.

• Time-Series Analysis – This analysis was performed to analyze the cargo shipping market over different periods to identify the trends and opportunities.

• Demand Side and Supply Side Data Triangulation – This analysis was utilized to synchronize and cross-validate the secondary data collected through extensive primary research and document review.

4. Primary Research:

The primary research methodology included in-depth interviews with the market experts. The experts included industry veterans, users, representatives from various associations, and industry service providers. All participants had very good knowledge of the cargo shipping market. The insights collected from the interviews revealed the market insights of cargo shipping as well as its future prospects.

5. Secondary Research:

Secondary research was conducted to gather data about the various parameters of the cargo shipping market. This includes data on economically active populations, labour costs, technological advancements, customer preferences, and other relevant factors. The data sources for the secondary research included white papers, company websites, industry journals, SEC filings, and paid database services.

6. Data Analysis:

Data was collected and analyzed from both primary and secondary sources. After the data was collected, the collected data was converted to actionable intelligence which was used for further analysis. The analysis was conducted using multiple approaches including the bottom-up approach, top-down approach, factor analysis, time-series analysis and demand-side and supply-side data triangulation.

7. Market Estimates and Forecasts:

The market forecast is made based on Market Research Future’s proprietary technology which uses historical data combined with machine learning algorithms to provide accurate market size and growth rate estimates for the cargo shipping market. The market estimates and forecasts were verified and validated based on the primary and secondary research findings.

Conclusion:

The research methodology used for this research study was a mix of both primary and secondary sources of data. Primary data was gathered through in-person interviews with experts in the field and secondary data was gathered from paid database services, industry journals, and company websites. The data collected was then analyzed using multiple approaches such as bottom-up approach, top-down approach, factor analysis, time-series analysis, and demand side and supply side data triangulation. Market estimates and forecasts were made using Market Research Future’s proprietary technology which utilizes historical data combined with machine learning algorithms. Overall, the research methodology adopted for this research study was comprehensive and ensured the accuracy of the market estimates and forecasts till 2030.