Demographic Shifts

Demographic trends are increasingly influencing the Certificate of Deposit Market Overview., as different age groups exhibit varying preferences for investment products. The aging population, particularly retirees, tends to favor the security and predictability offered by CDs, which aligns with their financial goals of capital preservation and steady income. Recent surveys indicate that nearly 70% of individuals aged 60 and above consider CDs a preferred investment option. Conversely, younger investors may exhibit a growing interest in alternative investment vehicles, yet the allure of guaranteed returns from CDs remains compelling. As financial institutions tailor their offerings to meet the needs of diverse demographic segments, the Certificate of Deposit Market Overview Industry is likely to adapt, ensuring that products resonate with both conservative and more adventurous investors.

Economic Stability

The overall economic climate significantly impacts the Certificate of Deposit Market Overview.. In periods of economic stability, consumer confidence tends to rise, leading to increased investments in low-risk financial products such as CDs. Current economic indicators suggest a steady growth trajectory, with unemployment rates remaining low and consumer spending on the rise. This environment appears conducive to fostering a favorable atmosphere for CD investments, as individuals seek to secure their savings while earning a predictable return. Furthermore, as economic conditions stabilize, financial institutions may respond by offering more attractive CD terms, thereby enhancing the appeal of these products. The interplay between economic stability and consumer behavior is likely to shape the future of the Certificate of Deposit Market Overview Industry.

Regulatory Changes

Regulatory frameworks play a pivotal role in shaping the Certificate of Deposit Market Overview.. Recent adjustments in banking regulations, particularly those aimed at enhancing consumer protection and transparency, have influenced how financial institutions design and market their CD products. For instance, the introduction of stricter disclosure requirements may lead to increased consumer confidence, thereby encouraging more individuals to invest in CDs. Additionally, compliance with these regulations could result in a more standardized market, potentially benefiting both consumers and institutions. As banks adapt to these changes, the overall landscape of the Certificate of Deposit Market Overview Industry is likely to evolve, fostering a more competitive environment that prioritizes customer needs and preferences.

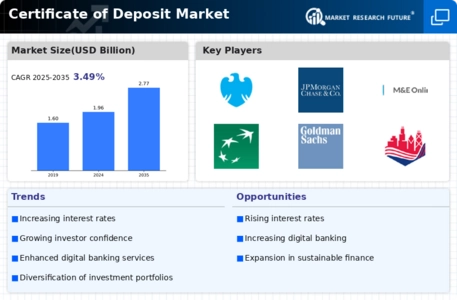

Rising Interest Rates

The Certificate of Deposit Market Overview. is currently influenced by the upward trajectory of interest rates. As central banks adjust their monetary policies, the increase in benchmark rates has led to higher yields on certificates of deposit. This trend appears to attract more investors seeking stable returns, as the average interest rate for CDs has risen to approximately 2.5% in recent months. Consequently, financial institutions are likely to enhance their offerings to remain competitive, potentially leading to a more robust market environment. The heightened appeal of CDs, particularly among risk-averse investors, suggests a shift in investment strategies, as individuals prioritize safety and guaranteed returns over volatile equities. This dynamic may further stimulate growth within the Certificate of Deposit Market Overview Industry.

Technological Advancements

Technological innovations are reshaping the Certificate of Deposit Market Overview., as financial institutions increasingly adopt digital platforms to enhance customer experience. The integration of online banking solutions allows consumers to easily compare CD rates and terms, facilitating informed decision-making. Recent data indicates that approximately 60% of consumers prefer to manage their financial products online, which has prompted banks to invest in user-friendly interfaces and mobile applications. This shift towards digital banking not only streamlines the investment process but also attracts a younger demographic that values convenience and accessibility. As technology continues to advance, the Certificate of Deposit Market Overview Industry may witness a transformation in how products are marketed and sold, potentially leading to increased participation from tech-savvy investors.